Vietnam

Vietnamese banks' problem loan ratio to improve to 6% in 2018

It already declined to 6.5% in June this year.

Vietnamese banks' problem loan ratio to improve to 6% in 2018

It already declined to 6.5% in June this year.

Vietnamese banks' asset quality expected to improve with new collateral repossession rules

Banks can now speedily repossess collateral for a nonperforming loan.

Everything you need to know about Vietnamese banks' improving asset quality

Impaired loans decreased from 12.7% to 8.4% of total loans in 2016.

Fintech startup Scale360 deploys teller-less branches in Vietnam

TPBank launched 12 digital branches in 1Q17.

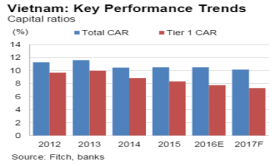

Vietnamese banks still troubled by low capital buffers

But it won't negatively impact financial stability over the near term.

Vietnamese banks still heavily burdened by delinquent loans

The VAMC has only managed to recoup 20% of the total outstanding bad debt.

Here's why consolidation is key for Vietnam's banking sector

None of its 31 banks have more than US450b in assets individually.

Vietnam banks to face capital shortfalls over the next 12-18 months

Banks' total capital gap was estimated to be US$9.5b in 2016.

UOB gets preliminary approval to establish subsidiary bank in Vietnam

UOB will be the first Singapore bank to be granted a foreign-owned subsidiary bank licence.

Vietnamese banks plagued by problem assets

The 2.6% NPL ratio reported in December was a grave understatement.

Vietnam Bank for Agriculture and Rural Development updates EMV network

Agribank now has improved security and fraud protection for its card services.

3 Asian countries remain the region's weakest links in terms of capital buffers

Other banks' leverage ratios are at 6%.

Vietnam banks' NPL ratio reaches 9%

The 2.4% NPL ratio reported at end-2015 was understated.

CIMB unveils first branch in Vietnam

This after the full-fledged banking licence was granted in September 2016.

Vietnam banks' problem assets ratio reaches 7.1% in the first half of 2016

That's including the gross value of assets sold to the Vietnam Asset Management Company.

Chart of the Week: Vietnam banks' capital buffers to remain under pressure

The banks' capital adequacy ratios are arely above the minimum requirement of 9%.

BIDV, Vietinbank, Vietcombank propose increasing foreign ownership limitation to 35%

Reducing the ownership of the State bank in their banks is another option.

Advertise

Advertise