Vietnam

Vietnamese banks' war against bad debt pays off

Lower credit costs lifted average operating profit/risk weighted assets from 1.6% in 2017 to 2.2% in H1 2018.

Vietnamese banks' war against bad debt pays off

Lower credit costs lifted average operating profit/risk weighted assets from 1.6% in 2017 to 2.2% in H1 2018.

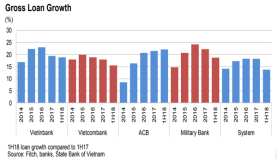

Chart of the Week: Vietnamese banks rapid loan growth moderates in H1

Retail and manufacturing loans drove H1 gains.

Vietnamese banks continue shedding bad debt in June

Non-performing loan ratio has fallen to 6.7%.

IFC seeks buyer for Vietnamese bank stake

This goes against the trend of greater investments in Vietnamese banks.

Capital crunch clouds Vietnamese banks' stellar half-year profit results

Lenders have been turning to IPOs and bond issuances to plug the gap.

Vietnamese banks step up bad loan disposal via auction

Agribank is planning to hold 12 auctions in September alone.

Can Vietnamese banks plug their massive capital shortage ahead of Basel II?

The banking system could face a $20b capital shortfall by 2020.

Vietnam intensifies crackdown against bad debt

Bad loan ratio fell from 2.46% in December 2016 to 2.09% in June.

Vietnam cracks down on Chinese mobile wallets

Banks are not officially connected to WeChat, making it illegal in the country.

Here's why foreign bank ownership cap is a boon for Vietnamese fintech

Investors may tie up with fintechs instead of banks.

Vietnam steps up efforts to boost weakened banking sector

The government aims to have up to five banks listed on foreign bourses.

Can foreign lenders break Vietnamese banks' legacy problem?

Foreign ownership caps and regulatory constraints block foreign bank entry.

Vietnam cracks down on issuing foreign bank licenses

The move aims to encourage local banking mergers.

UOB unveils subsidiary in Vietnam

It's the first Singapore bank to open a foreign-owned Vietnamese unit.

Vietnamese banks grapple with $9b capital crunch as lending outpaces capital generation

Tier 1 Capital ratio could fall from 9.4% to 8% by 2019.

Vietnamese banks' strong lending dampens capital raising activities

Loan growth of about 20% is outpacing internal capital generation.

Vietnamese banks urged to tighten card issuance

A group claims that 50 million of the 132 million cards in circulation are not being used.

Advertise

Advertise