Vietnam

Vietnam bank loans grew 6.16% in May

This represents a slightly faster expansion than the previous months.

Vietnam bank loans grew 6.16% in May

This represents a slightly faster expansion than the previous months.

Vietnamese banks intensify capital raising activities as Basel II deadline looms

Lenders have been using retained earnings to lift CAR.

Vietnam banks speed up transition to chip cards

The shift from magnetic is expected to provide better cardholder protection.

Foreign banks flock to Vietnam

Korean lenders have been eagerly expanding their foothold in the country.

Vietnam's OCB guns for $1b market cap in Vietnam IPO

The bank intends to sell $35m of shares via private placement in Q3.

Vietnamese banks gun for greater market share of consumer finance pie

The local market is expected to be worth $44b by 2020.

Vietnam's loan growth beats new year slump after rising 5% from January to April

The government is doubling down on the country’s bad debt.

VPBank unveils digital credit card

It aims to provide users with digital alternative to the delayed delivery of physical cards.

Can the VAMC single-handedly halt Vietnam's bad loan woes?

It has already bought $9.4b in NPLs from various banks.

Can Vietnam halt the exponential growth of its bad debt?

VAMC was able to resolve 27.9% of NPLs it purchased in 2017.

VietinBank to launch digital business matchmaking platform

It aims to provide companies with connections to expand into new markets.

Vietcombank automates trade finance processes

It has partnered with fintech firm Finastra to digitise its operations.

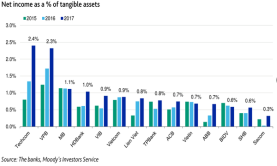

Chart of the week: Check out how Vietnam banks' profitability improved in 2017

Stable economic conditions and a robust core income segment buoyed earnings.

Vietnam banks' average asset return rose to 0.9% in 2017

The healthy figures are partially due to strong core income segment.

Vietnam banks to benefit from resolving legacy problem assets progress

The disposal of problem assets improves banks' asset quality.

VietinBank migrates all debit card transactions

This is to improve issuance for international and domestic debit and credit cards.

4 factors that will drive the deterioration of Vietnamese banks' capitalisation

Credit growth and provisioning costs will erode capitalisation.

Advertise

Advertise