Singapore

Challenging times ahead for Singapore's banking industry

Delinquencies are sighted to rise from SMEs, large corporates, and retail customers.

Challenging times ahead for Singapore's banking industry

Delinquencies are sighted to rise from SMEs, large corporates, and retail customers.

Will open banking be the next wave of digital transformation in Asia's financial industry?

Open banking is emerging as a key trend and the next ‘wave’ of digital transformation in global financial markets. At its core, it is focused on data sharing, which is enabled through application programming interfaces (APIs) which make it possible for two different systems to ‘share’ information with each other. Simply put, this means that consumers will have greater control over their financial data and who to share it with. An example of this in practice would be a mobile banking application that enables users to see all of their financial information and spending habits (across different bank accounts) on one interface.

Citi Singapore to support industry-wide relief programme

The bank also launched relief measures to support its clients.

Weekly Global News Wrap: Global banking systems may need restructuring; Major UK banks scrap dividend payments

And Goldman Sachs, Morgan Stanley OK’d for majority stakes in China ventures.

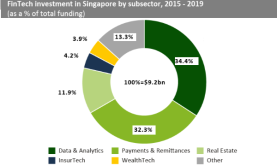

Chart of the Week: Data & analytics firms clinched 34.4% of Singapore's fintech deals since 2015

Local fintech companies raised more than $9.2b across 389 deals during this period.

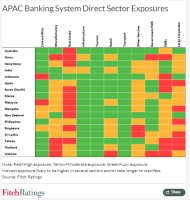

Sri Lanka's banks face dampened outlook for 2020

Announced regulatory policies aren’t enough to shield the sector from the pandemic’s punches.

Citi swipes Amex global cards head

Citi has recruited Kartik Mani as the Asian head of cards and unsecured lending, according to an announcement. He will be responsible for lending and partnerships in Asia.

MAS establishes $60b USD facility for banks

It aims to support more stable USD funding conditions in Singapore.

DBS floats digital relief solutions for COVID-hit F&B businesses

Businesses will be able to establish an online presence within three business days.

Weekly Global News Wrap: European banks' loan blues; US urge banks to aide COVID-hit customers

And some US lenders hand out bonuses to staff amidst the pandemic.

Singapore monetary board asks financial firms to ensure COVID-19 distancing measures

Online platforms and employee distancing should be implemented.

Red Hat transforms banking with groundbreaking software solutions

Banks can cope with disruption through Red Hat's cost effective solutions.

Asian banks stuck in an unprofitable bind

Market profitability and credit demand are likely to be affected.

DBS provides $122.08m sustainable loan to HK listed REIT

Proceeds will be used for general corporate funding purposes.

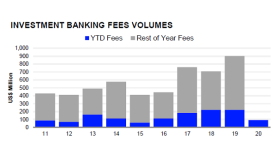

Singapore's investment banking fee revenue down 58.7% to $91.9 in Q1

Advisory fees for M&A deals plunged 80.4% YoY to $11m.

Fintech startup MatchMove applies for digital bank license

It partnered with lender Singapura Finance and other fintechs for its bid.

Revolut brings Apple Pay to Singapore

Users can add their cards to Apple Pay using the Revolut app.

Advertise

Advertise