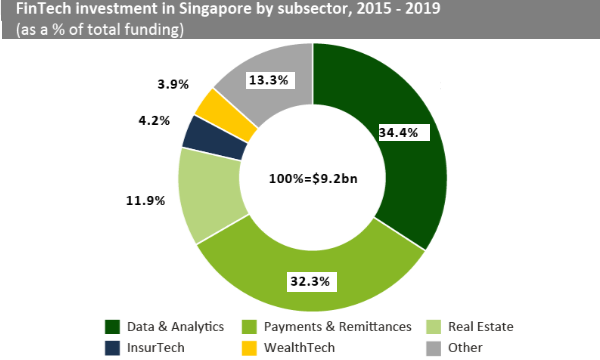

Chart of the Week: Data & analytics firms clinched 34.4% of Singapore's fintech deals since 2015

Local fintech companies raised more than $9.2b across 389 deals during this period.

Data and analytics companies captured over a third of 34.4% of Singapore’s total fintech investments since 2015, according to a report by Fintech Global.

Singapore fintech companies raised more than $9.2b across 389 transactions during the same period.

The data & analytics subsector has thrived due to the country’s access to a global talent pool, strong infrastructure, Smart Nation push (supports innovation and ambitious tech projects), and their tech-savvy government, the report noted.

The largest transaction in the country during the period was raised by Sea, a Singapore internet platform company who owns the e-commerce platform Shopee. The company raised $1.4b in a post-IPO equity round led by Tencent Holdings in March 2019.

The Other category contains companies operating in Marketplace Lending, Blockchain & Cryptocurrencies, RegTech, Institutional Investment & Trading, Infrastructure & Enterprise Software, and Funding Platforms subsectors, which collectively raised 13.3% of fintech investment in the country.

Advertise

Advertise