Singapore

DBS launches portfolio advisory tool for managing investments

It generates an assessment of a client’s portfolio in less than five minutes.

DBS launches portfolio advisory tool for managing investments

It generates an assessment of a client’s portfolio in less than five minutes.

CIMB Singapore announces new measures for coronavirus-hit firms

Tourism-related firms are eligible for a $1m loan with a 5% interest rate.

Weekly Global News Wrap: CEO changes bring in new age of European banking; Wells Fargo pays $3b settlement for fraudulent sales

And JPMorgan confident that it could withstand economic stresses.

Singapore central bank warns of fake calls impersonating staff

It stressed that it would never ask the public for personal or bank information.

DBS converts $758m bank guarantee facility into green facility

Wind turbine maker Siemens Gamesa will issue green guarantees under the facility.

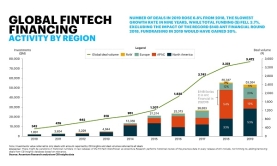

Singapore's fintech investments hit $1.21b in 2019

It is now the fifth biggest fintech market in APAC.

DBS Group prices $1.4b issue at 3.3%

The deal is said to bear the lowest coupon for any AT1 USD deal in the world.

CIMB Singapore launches virtual account for businesses

It digitises companies’ cash flow.

UOB's net profits up 8% to $3.08b in FY2019

A final dividend of $0.39 (S$0.55) and a special dividend of $0.14 (S$0.2) was as recommended.

UOB to launch digital bank in Indonesia

TMRW is on track to be marginal profit positive in five years.

DBS to give abridged Q1, Q3 financial disclosures

These updates will supplement the half-year and full-year reports.

OCBC's net profits up 34% to S$1.24b in Q4 2019

Core net profit leapt 10% to S$4.9b in FY 2019.

Bank managements should take advantage of increased certainty and use dividends as a tool to manage returns

Bank management teams have faced many challenges in the decade post the global financial crisis. After stabilising balance sheets in its immediate aftermath, there was a need to build capital as the Bank of International Settlements’ (BIS) regime was tightened. More recently banks have had to conceptualise the threats and opportunities posed by fintechs, and more latterly by ‘big tech’ companies and invest to meet the challenge. In addition, within South East Asia, banks have had to deal with the GDP slowdown post 2013, and the impact this has had on loan growth and credit quality.

Can Ping An Bank weather weakening interest rates?

Its retail lending clients are less sensitive to borrowing rates..

Standard Chartered names new digital channels and client data analytics head

Karina van Dyke will join the bank’s CCIB division in Singapore.

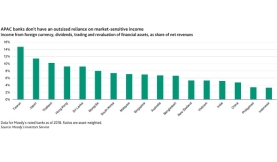

Chart of the Week: APAC banks not reliant on market-sensitive income

Further drops in prices of financial assets are likely if the COVID-19 outbreak persists.

Weekly Global News Wrap: JPMorgan reshuffles investment bank; Fintech firm LendingClub buys Radius Bank for $158m

And customers were outraged by N26 UK exit.

Advertise

Advertise