China

Dufry to co-develop duty-free shop in Hainan

Dufry to co-develop duty-free shop in Hainan

The first phase is planned to open before the Spring Festival in 2021.

Tencent invests $100m in online grocery startup Xingsheng

Analysts expect the startup’s current funding round to be followed by an IPO.

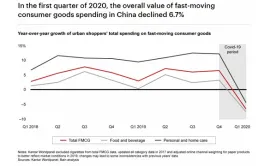

China's FMCGs suffer lower selling prices in 9M 2020

Leading e-commerce players have focussed more on bargain-conscious consumers.

Huawei sells Honor business to consortium of agents, dealers

Its consumer business took hit from an unavailability of needed technical elements.

Weekly News Wrap: China drafts rules on livestreaming sales; Diwali festival boosts lacking for India's jewelry stores

And Alibaba and JD.com hit a record $115b sales in Singles Day event.

Strong recovery ahead for Asia's luxury sector

Majority in Asia have plans for leisure travel in the next 12 months.

Sa Sa's turnover down 55.3% to $89.75m in Q2

The lack of tourists affected its sales to mainland customers.

How Alibaba addressed international merchants' hurdles of accessing the China market

They rolled out an English-language customer-service and self-service registration system.

Weekly News Wrap: China offers glimpse to post-pandemic retailing; Eviction looms for Hong Kong's stores

And gold rally boosts Malaysia’s jeweler stocks.

Alibaba's income doubled to $6.74b in Q2

Its China retail and cloud computing businesses boosted revenue growth.

China's retail sales down 1.1% to $463b in July

Goods saw positive growth for the first time, but the catering sector remained weak.

How will China's FMCG sector shift post-pandemic?

Top brands benefit from strong brand equity and scale advantages.

Burberry launches social retail store in Shenzhen, China

It showcases an interactive window upon entrance.

Weekly News Wrap: China's July auto sales to grow 14.9%; Filipino retailers reel from weak foot traffic

And Melbourne, Australia is shutting down most of its retail sector for six weeks.

Consolidation underway amongst China's condiment brands

The top five players in the segment account for only 21% of the market share.

Influencers offer lucrative channel for China's FMCGs: report

Brands linked to comfort or cleanliness are best placed to benefit from Wanghong.

Weekly News Wrap: Chinese firms tap e-commerce platforms; Japan's retailers turn to digital tools

And India’s Reliance Industries looks to buy Future Group’s retail operations for $3.6b.

Advertise

Advertise