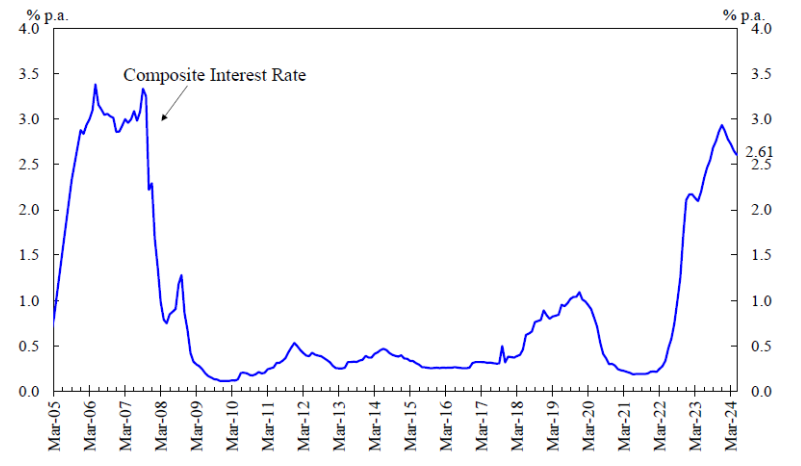

Hong Kong banks’ composite interest rate falls 4bp to 2.61% in May

This was due to a decrease in weighted funding cost for deposits during the month.

Hong Kong banks’ composite interest rate came at 2.61% at end May 2024, according to data from the Hong Kong Monetary Authority (HKMA).

This is 4 basis points (bp) lower than the 2.65% in end-April.

The decrease in composite interest rate mainly reflected the decrease in the weighted funding cost for deposits during the month, the HKMA said.

The composite interest rate is the weighted average interest rate of all Hong Kong dollar interest-rate-sensitive liabilities. This include deposits from customers, amounts due to banks, negotiable certificates of deposit and other debt instruments, and all other liabilities that do not involve any formal payment of interest but the values of which are sensitive to interest rate movements (such as Hong Kong dollar non-interest bearing demand deposits) on the books of banks.

Data from retail banks, which account for about 90% of the total customers’ deposits in the banking sector, are used in HKMA’s calculation.

Mortgage loan applications in Hong Kong rose 11.7% in April compared to a month earlier, according to HKMA data.

Advertise

Advertise