Housing loans, online loans most popular in SEA: study

Analysts said the rise in home loans is likely caused by the region’s geolocation.

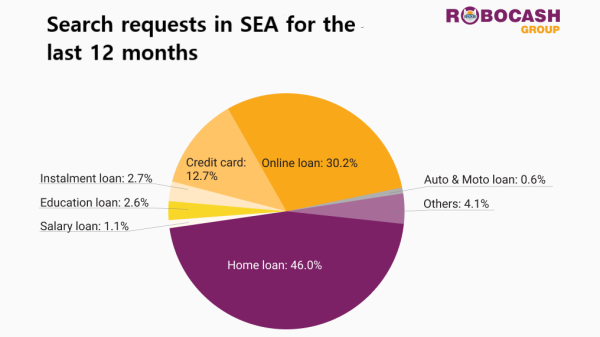

In the past 12 months, housing loans accounted for 46% of all lending-related search queries in the Southeast Asia region, according to a recent study by Robocash Group.

Online loans are the second most popular choice, comprising 30% of the market.

“According to the UN, Southeast Asia is one of the fastest growing regions in terms of both the urbanisation of the population and the rate of household growth. It follows that residents need funding to build their own homes.” analysts from Robocash said.

Furthermore, another contributing factor was the geolocation of Southeast Asia – the region surrounded by two major oceans – which caused flooding in coastal areas of these countries.

ALSO READ: SEA gains 8.1 million new fintech users in Q1: study

Credit cards rank next at 13%, followed by instalment loans at 3%, education loans at 3%, salary loans at 1%, auto & moto loans at 1%, and miscellaneous options at the remaining percentage.

The study conducted by Robocash encompassed Singapore, Thailand, Malaysia, Indonesia, Cambodia, the Philippines, Vietnam, Laos, Myanmar, and Brunei.

It utilised monthly data from Google Ads spanning from January 2020 to April 2023.

A total of 88 combinations of lending-related keywords were used, and the data were categorized into broader groups including Auto & Moto loan, Salary loan, Home loan, Education loan, Credit card, Instalment loan, Online loan, and others.

Advertise

Advertise