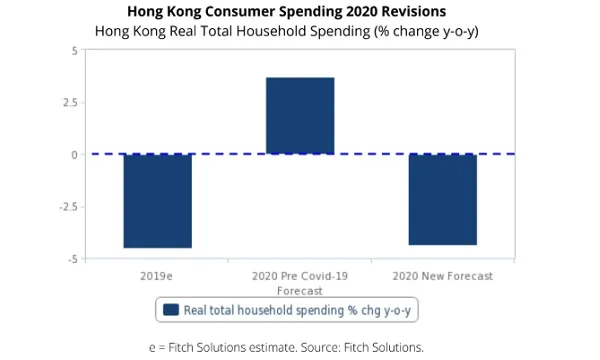

Hong Kong's household spend to contract 5.2% in 2020

Some food service chains have reduced operating hours.

Hong Kong’s household spending is tipped to contract 5.2% YoY in 2020 as consumers have been diligently avoiding crowds and retail establishments in fear of contracting the virus, according to a Fitch Solutions report.

As government measures are made to stem the flow of the COVID-19 infection, purchasing patterns have been observed to undergo shifts, with consumers placing a greater focus on essential spending categories.

Also read: Hong Kong's retail sales down 44% to $2.93b in February

The city was the first region where panic buying and hoarding was recorded in relation to the pandemic, when consumers in 2020 feared that they would lose access to toilet paper and other supplies if their land border with China was sealed. With this, three sectors, all relating to food and supermarkets, saw a double-digit increase in sales in February 2020.

As the population became health and hygiene conscious following the 2003 SARS outbreak, the pandemic could drive them to become even more aware of their health, and boost the sales of health related goods at pharmacies or traditional Chinese medicine shops.

On the other hand, the population has avoided restaurants and other recreational spaces, and some food service chains have either reduced operating hours or closed their dine-in services.

Further, it was decreed on 2 April that any premises that are exclusively or “mainly” used for the sale or supply of alcohol are to be shuttered, which affected about 1,200 bars and pubs across the city.

For the furnishing sector, major companies in the city have yet to reveal revenue declines, but furniture retailer Pricerite has cut executive pay by 40%, which could hint at the pressures the company is facing.

As of 1 May, Hong Kong has recorded 1,038 cases of infections and 4 deaths, one of the very few economies in the world that has not yet ordered a lockdown.

“Although there have been brief returns to normalcy, as the government got a stronger grip on the outbreak in late February and March, the rise of imported cases in late March and early April pushed residents indoors again,” the report noted.

Advertise

Advertise