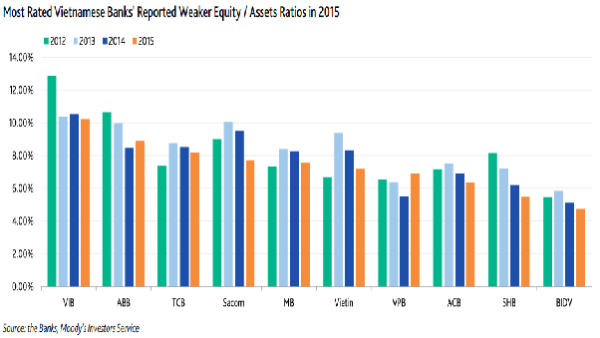

Vietnamese banks suffer from weaker equity-to-asset ratios

It decreased to 7.3% as at end-2015.

Most banks rate by Moody's reported declines in their equity/total assets ratios in 2015, which reflected not only higher credit costs, but also the system’s rebound in credit growth. The banks’ average equity/total assets decreased to 7.3% at end-2015, from 7.7% at end-2014.

"For 2016, we expect a further weakening in the banks’ capital buffers as credit growth and provisioning expenses outpace the capacity for internal capital generation. Banks also have few sources of external capital, given limited domestic resources and restrictions on foreign investments in banks. There is a limit of 30% on total foreign ownership per bank, and most rated banks are at and close to the cap," says Eugene Tarzimanov, VP - senior credit officer at Moody's.

"These observations continue to underpin our concerns that Vietnamese banks’ weak capital levels will remain a constraining factor for their credit profiles, even as asset quality pressure has stabilized," he adds.

Advertise

Advertise