US dollar deposits accounted for a third of Singapore's total bank deposits in March

USD deposits rose at a CAGR of 20% over the past nine years.

Banks in Singapore have significant US-dollar exposure which represent 26% and 31% of total loans and deposits as of end-March following active regional expansion, according to Fitch Solutions.

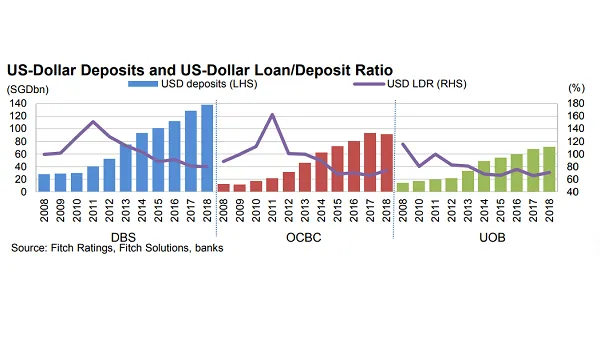

The banking sector’s combined US dollar deposits grew at a compound annual growth rate (CAGR) of 20% over the past nine years to outpace the US-dollar loan CAGR of 18%, following significant gains in transaction banking and wealth management franchises, observed analyst Wee Siang Ng.

Lenders have also been tapping on wholesale debt markets to diversify US-dollar funding profiles, with US-dollar debt outstanding for OCBC and UOB rising to 17% and 23%, respectively, of total US-dollar funding in 2018, from 12% and 9% in 2010. Although DBS does not provide data, it is unlikely to deviate significantly from its two peers, said Ng.

With modest US-dollar loan/deposit ratios (LDR) at 67-79% in Q1 and 75-80% over 2015-18, Ng believes that there is still room left to manoeuvre.

“The agency believes there is headroom for Singapore banks to withstand temporary US-dollar liquidity outflows,” he said. “We expect the banks to be able to tap the foreign-exchange swap market to convert their ample Singapore-dollar excess liquidity into US dollars, and potentially run down US dollar-denominated trade loans to conserve liquidity, if needed.”

Despite the room for growth, the underlying strength of the banking sector’s US-dollar funding remains untested under a stress scenario characterised by a severe deterioration in liquidity conditions. Ng notes that it was only in 2011 where banks started to meaningfully increase US-dollar deposit base.

Advertise

Advertise