Thailand banks' Q3 profits to drop 14% as fee waiver bites

Earnings will take a hit from weak non-interest income.

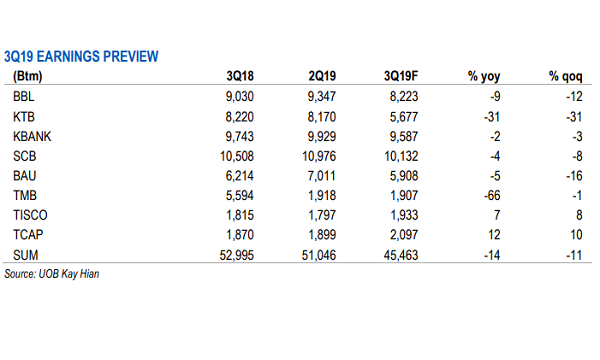

The net profit of Thailand’s banking sector is tipped to fall 14% YoY on the back of weak non-interest income and sluggish top-line growth, according to UOB Kay Hian.

Also read: Thai banks' loan growth may slow to 4.1% by end-2019

“[N]on-interest income of the sector is expected to drop 14% yoy from the absence of sizeable one-off gains from the sale of TMB’s asset management firm,” analyst Thananchai Jittanoon said in a report.

The waiver of digital banking fees is likely to have weighed on fee income although capital market incomes should rebound in line with stock market activities.

Amongst the big banks, Krungthai Bank earnings will crash 31% due to the booking of employee benefits around $75.83m (THB2.3b), pushing sector opex by 7%. TMB profits is also poised to plunge by 66% due to the absence of investment gains.

Loans are expected to grow by a sluggish 4-5% by Q3 amidst tepid growth in housing and corporate loans. For the full-year period, loan growth is expected to fall somewhere between 4.7-5%.

Advertise

Advertise