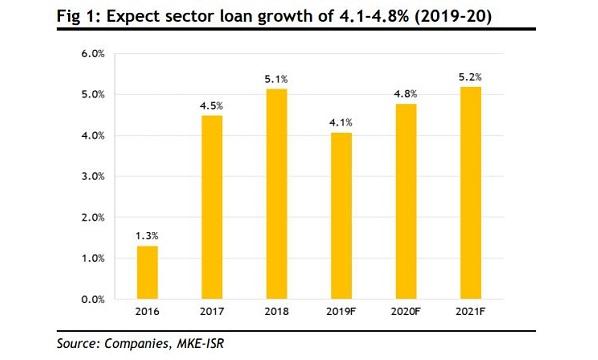

Thai banks' loan growth may slow to 4.1% by end-2019

SME loans and mortgages will grow at a slower pace.

The loan books of banks in Thailand are tipped to expand at a slower pace of 4.1% by end-2019 from 5.1% in the previous year, according to a report from Maybank Kim Eng. Loan books are expected to grow slightly to 4.8% by 2020 and 5.2% by 2021.

SME loans are tipped to grow at a weaker pace as banks remain wary of extending credit to the sector given their vulnerability in a weakening economy, according to Jesada Techahusdin, CFA at Maybank Kim Eng. SMEs account for a little over a third (33.6%) of Thailand banks' overall loans.

Also read: Thailand brances for fresh wave of bad loans as property market cools

Moreover, mortgages are also tipped to slow amidst the government's punitive measures that kicked into effect on 01 April. For property values of more than $320,000 (THB10m), the central bank has capped LTV ratios at 80% for first and second mortgage loans and 70% for the third. The respective ratios used to be 80% for all contracts.

Lending gains for the year will be driven by corporate and auto segments although banks are expected to continue lending for used-car purchases and car refinacning than new purchases.

Advertise

Advertise