Should New Zealand banks brace for earnings blow amidst higher capital requirements?

Major banks would need around $4,55b if the proposal is implemented.

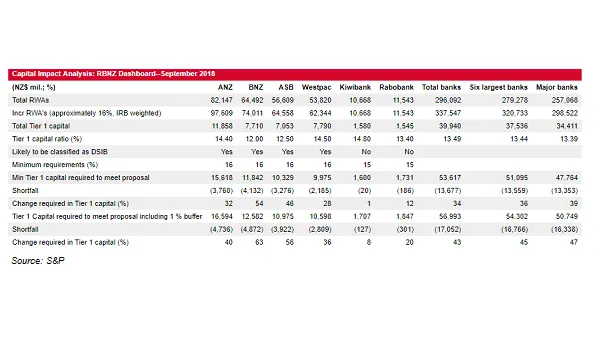

The proposal from the central bank of New Zealand to increase the regulatory capital requirements of its lenders would entail banks to raise Tier 1 capital levels by a minimum of $9.45b (NZ$13.7b) or about a third from current levels, according to a report from S&P, a development which could easily hit the Australian parents of Kiwi banks.

The cenral bank put forth a suggestion of an increase in minimum regulatory Tier 1 capital equivalent to 16% of RWAs for systemically important banks and 15% for all other banks from the current minimum regulatory requirement of 8.5%.

"We estimate the capital requirement for the increase in RWAs for internal ratings based (IRB) banks at the proposed capital standards to be about $4.55b (NZ$6.6b) for the four New Zealand major banks," analyst Nico DeLange said in a statement. “We expect that the parents are highly likely to provide timely financial support for the New Zealand major banks, if needed."

The firm noted that the Australian Prudential Regulation Authority (APRA) requires banks to meet minimum capital requirements on both a level 1 and level 2 basis.

With this, the four major Australian banks including ANZ, NAB, CBA, and Wespac may need to inject $5.82b (A$8.1b) in order to maintain their overall level 1 Tier 1 capital ratios at about their current levels. Amongst the four, ANZ may need to inject the highest amount of around $1.8b (A$2.45b).

Advertise

Advertise