Hong Kong's first virtual bank starts operations

The firm is offering a savings rate of 1% for deposits up to $500,000.

ZA Bank, the digital-only banking unit of Chinese insurer ZhongAn, has officially begun operations on 24 March, the company announced on its website. This makes it the first of Hong Kong’s eight new neobanks to do so.

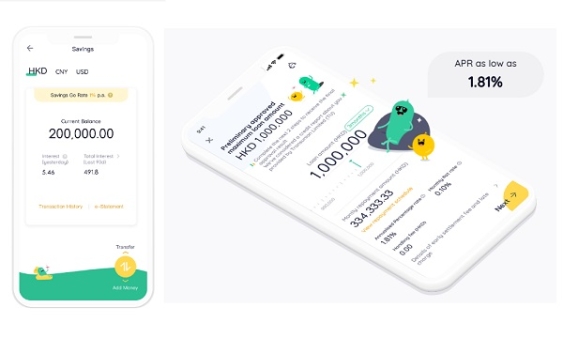

The bank kicked-off its first day with the launch of ZA Savings Go, which promises a 1% savings rate for a deposit value of up to $500,000 (US$64,400) compared to the 0.001% general savings deposit rate. The basic savings rate will apply to the balance exceeding the first $500,000.

ZA Bank has also launched a tax season loan service, pledging to approve loans of up to $1,000 (around US$128) in as fast as 30 minutes. The customer can receive $10 (about US$1.29) for every minute that ZA Bank goes over time, for a maximum of $500 (US$64.5).

Advertise

Advertise