Chart of the Week: New Zealand proposes ambitious $9b bank capital buffers

The central bank is putting forward a prudential capital buffer of 9-10%.

New Zealand's banking sector may need to increase CET1 capital by a total of $9.61b (NZD14b) over the next five years in line with an ambitious central bank proposal to strengthen bank buffers to withstand stress, according to Fitch Ratings.

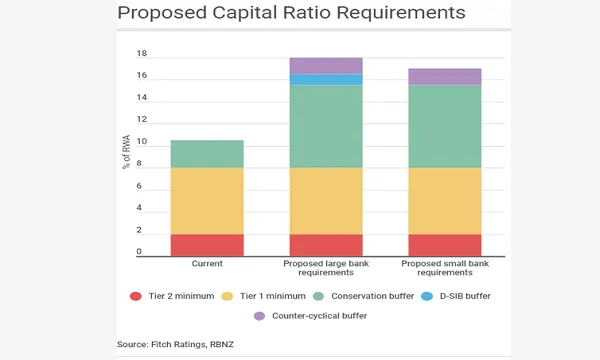

The Reserve Bank of New Zealand (RBNZ) is setting a prudential capital buffer of 9-10% of risk-weighted assets which would raise minimum CET1 requirements to at least 16% of RWA for domestic systematically important banks (D-SIBS) and 15% for all other banks.

Also read: Australia mulls higher capital requirements in new blow to bank earnings

"The RBNZ's proposals also go well beyond the international norm in addressing RWA differences between the banks that use the internal-rating based (IRB) approach - the four major banks - and banks using the standardised approach," Fitch Ratings noted in its report, adding that the central bank expects its adjustment of its 'IRB Scalar' and output floor to increase the average RWA calculation of IRB banks to 90% of the outcome under the standardised approach, which is much higher than the 72.5% "fully-loaded" output floor finalised by the Basel Committee in December 2017.

Banks are unlikely to face significant roadblocks to meet the new capital requirements although major banks may increase lending rates in a bid to earn a commensurate return on the invested capital which could set the tone for smaller banks.

The RBNZ is still consulting on the proposal until March 29,2019 as it expects to finalise the framework by June 2019 where it will also publish a D-SIB framework and confirmation of identified D-SIBs.

Advertise

Advertise