Chart of the Week: Indian banks hit by liquidity crunch

The growth in bank credit has eclipsed that of deposits which aggravated liquidity shortage.

India's banking system continued to face liquidity shortages even as daily average liquidity eased slightly to $13.42b (RS94,585 crs) in February 25-28 from $18.28b (RS128,851 crs) in the preceding week, data from Care Ratings show.

The liquidity infusion by the central bank by way of OMO purchases helped plugged the deficit, Madan Sabnavis, chief economist said in a report.

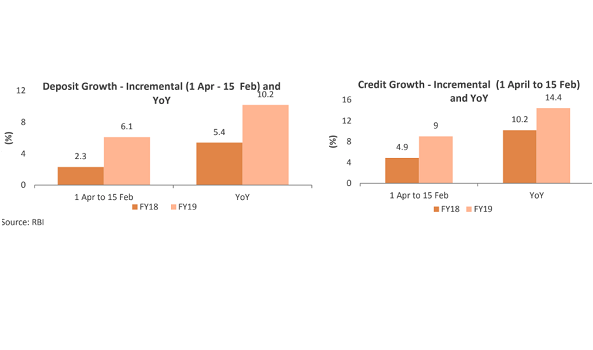

However, bank credit growth, which has been trending higher in recent months, continued to surpass the growth in deposits which has partially contributed to the liquidity crunch. Credit growth as of February 15 hit 14.4%, whilst deposit growth stood at 10.2%. On an incremental basis (April 2018 - Februarly 2019), bank credit has grown by 9%, whereas bank deposits have grown by 6.1%.

Also read: Indian banks swing back into the black in Q4

The positive development comes as Indian banks slowly recover from their crippling bad loan burden and achieve gains from their lending businesses. “[W]e expect the gradual cleaning up of non-performing loans in the banking sector to be supportive of new loan issuances over the coming quarters, and this should support the continued expansion of financial services,” Fitch Solutions said in an earlier report.

Advertise

Advertise