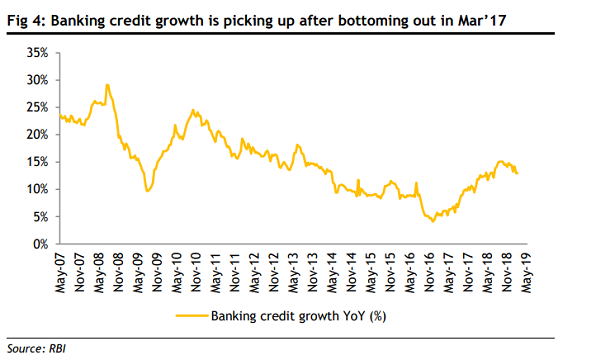

Chart of the Week: Indian banks' credit growth hit 13% in May

Home and retail sectors drove lending gains.

This chart from Maybank Kim Eng shows that India’s credit growth is getting in the pink of health as it picked up 13% YoY in May. In mid-April, credit grew at a strong double-digit pace of 13.2%, higher than the 10% in the same period a year ago.

The month’s lending gains was driven by home loans, other retail loans, the services sector and loans to non-bank financial corporations (NBFCs).

Also read: India's weakened banking sector awaits stronger credit growth as it tucks bad loans away

India has been plagued with persistent bad loan problems although lenders are recovering and achieving gains in their lending businesses thanks to government capital infusions. Credit growth in the country bottomed out in March 2017 when loan growth fell to 5%.

“[W]e expect the gradual cleaning up of non-performing loans in the banking sector to be supportive of new loan issuances over the coming quarters, and this should support the continued expansion of financial services,” Fitch Ratings said in a previous report.

Advertise

Advertise