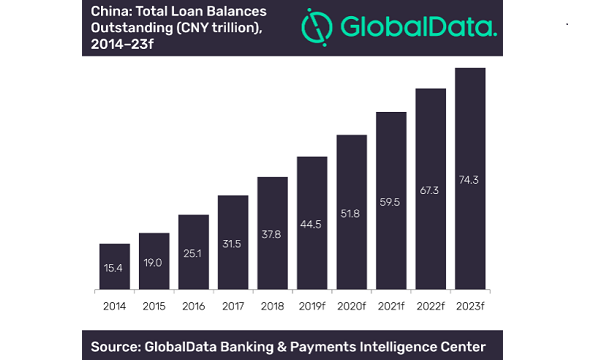

Chart of the Week: China to dominate Asia's retail lending market

The domestic market will grow at a CAGR of 13.7% from 2019-2023.

China is once again casting its massive shadow over the rest of the region as the country is expected to continue leading Asia's retail lending landscape over the next five years with the domestic market tipped to grow at a robust compound annual growth rate of 13.7% during 2019-2023, according to GlobalData.

This comes on the heels of an already strong growth rate where total loan balances expanded at a CAGR of 25.2% from $2.2t (CNY15.4t) in 2014 to $5.5t (CNY37.8t) in 2018.

“The availability of easy loan acquisition facilities for even subprime borrowers, coupled with the proliferation of non-bank lenders providing same-day loan approvals and unsecured loans at competitive interest rates, resulted in the rapid increase in household debt between 2014 and 2018," Ravi Sharma, Senior Analyst at GlobalData said in a report.

Home loans accounted for the lion's share of Chinese loan balances followed by credit cards and personal loans. Mortgages grew at a CAGR of 24.8% during 2014-18 and remained the largest category as it benefitted from growing house prices and loose property investment rules.

In addition, China’s gross savings rate stood at 45.7% in December 2018 – one of the highest savings rates in the world – reflecting Chinese consumers’ preference to save rather than spend. Coupled with a global equity market downturn, the Chinese retail deposit market posted a healthy CAGR of 9% during the review period.

Advertise

Advertise