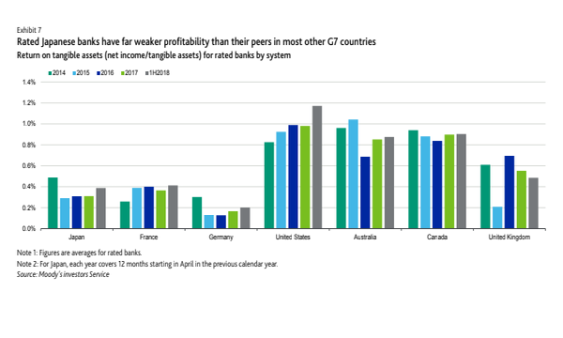

Chart of the Day: Japan banks' profitability still lag behind G7 peers

The sector’s return on assets hit 0.4% in H1 2018, below 1.2% in the US and over 0.8% in Australia.

This chart from Moody’s Investors Service shows that although the average return on assets (ROA) of rated Japanese banks rose to around 0.4% in the first six months of 2018, the sector’s profitability remained far below that of banks in most other G7 countries such as the United States, Australia, Canada and the UK.

Also read: Japanese banks hit by lower net interest income as loan demand dwindles

Moreover, Japanese banks’ ROA is also lower than its 2014 level when it stood at around 0.5%

“Banks' profitability will continue to deteriorate because of ultralow interest rates. The core profitability of all Japanese banks, which excludes net credit costs and gains from equity sales, has fallen more steeply than net income since 2014, underscoring challenges from falling interest rates in the country,” Moody’s said in a report.

Japan’s banks have long been bearing the brunt of prolonged monetary easing and a rapidly shrinking client base which has been taking a heavy toll on bank profits. Megabanks are not exempt from the structural decline as MUFG saw annual profits fall 12% and Mizuho’s earnings plunged 83% in its weakest performance since 2008.

Advertise

Advertise