Staff Reporter

,

Indonesia

They've kept their loan-deposit ratios low.

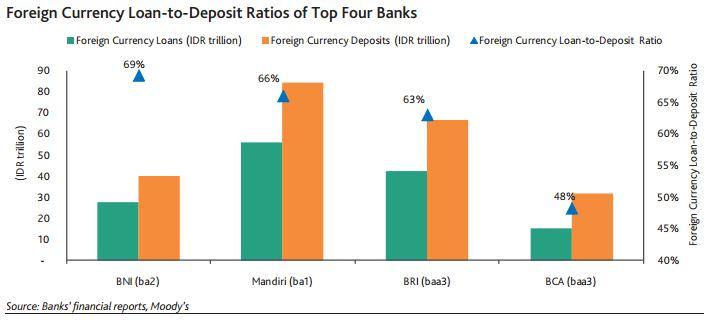

According to Moody's, the top four Indonesian banks have kept their loan-deposit ratios low in recent quarters.

"As illustrated in the graph, the top four are in an advantageous position with foreign currency deposits exceeding foreign currency loans. This situation reduces our concerns about excessive un-hedged borrowings, which could become problematic, given a depreciating IDR."

Join

Asian Banking & Finance

community

Since you're here...

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you dight and create an advertising campaign, in print and digital, on this website and in print magazine.

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Advertise

Advertise