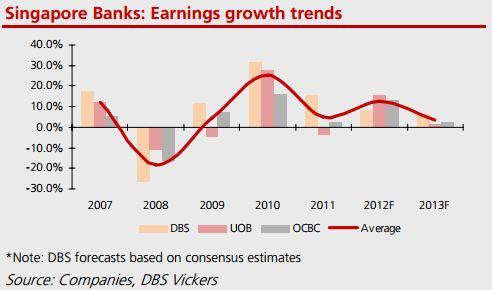

This graph shows Singapore banks' earnings growth trends till FY13

DBS, OCBC, and UOB are in for more disappointing earnings ahead.

DBS Vickers expects earnings to contract 6% q-o-q premised on further NIM compression and slower loan growth while non-interest income and expenses should remain stable.

Here's more from DBS:

We expect a slight uptick in provisions although credit charge of rates should still remain low. The positive earnings y-o-y was a result of a weak 3Q11 due to weak non-interest income.

We have cut FY13-14F loan growth to 8% each (from 10%). We raised our credit charge-off rates by 2-4bps to 31-32bps purely taking into account possible macro weakness and the strong loan growth the banks had booked over the past 6 quarters.

With no visibility of NIM improving, we have trimmed our FY12F NIM marginally by 1-2bps, but slashed FY13-14F NIM by 3-11bps. We had initially expected NIM to stay flat in FY12F and gradually inch up in FY13F and then benefitting from SIBOR hikes in FY14F, but these are now further protracted. All in, we have reduced FY13-14F earnings by 4-7%.

Advertise

Advertise