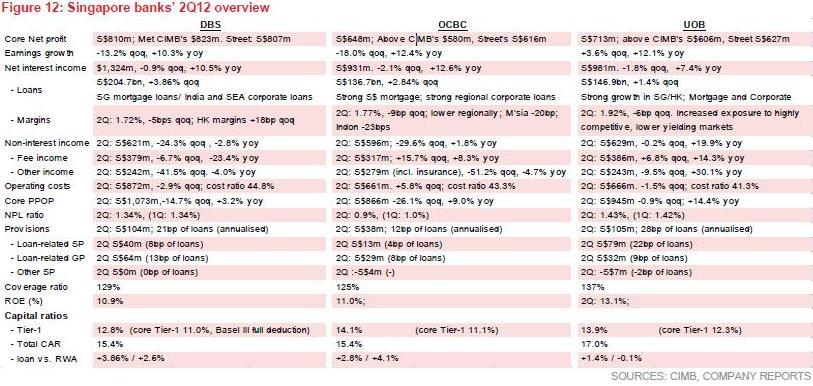

Check out how DBS, OCBC, and UOB fared in 2Q12

Analysts' optimism for the sector is dampened as signs of slowing revenue growth in 2Q raise concerns.

According to CIMB, Sector NII fell 1.5% qoq. Loans grew 2.8% qoq. Margin compression from lower lending yields and funding competition led to a decline in sector NII. NIMs fell 5-9 bps across the sector.

Loans growth outpaced deposits in the quarter. LDR crept up from 84.3- 86% in 1QFY12 to 86.3-89% in 2QFY12. S$ liquidity remained comfortable for all three banks, with LDR at 67-89.5%, CIMB added.

"Concerns on asset quality were unfounded in 2QFY12. While banks are turning cautious in 2H12 and have taken to making stringent re-classifications, asset quality has not deteriorated. NPL ratios remained low at 0.9-1.4%. Provisioning remained largely stable at 125-137%."

Advertise

Advertise