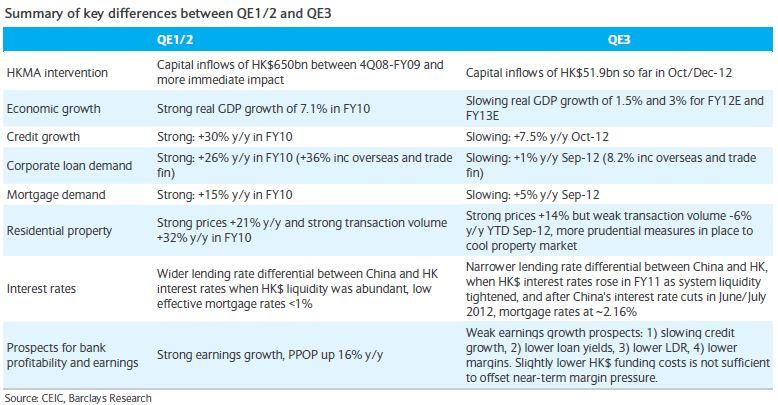

Check out the differences between QE1/2 and QE3 for Hong Kong banks

Barclays expects further capital inflows under QE3 to lead to abundant liquidity in Hong Kong.

According to Barclays, during QE1, the HKMA sold HK$650bn when the HKD hit the strong side of the currency trading range of 7.75, between September 2008 and December 2009. This is reflected in the aggregate balance and exchange fund papers outstanding of the HKMA.

"During QE2, there was no change in the aggregate and exchange fund balance as the HK$/US$ exchange rate did not touch 7.75, as the HK$ was weakening against the US$. However, capital inflows were evident as the M2 balance rose by 13% in the year after November 2010. We expect further capital inflows under QE3 to lead to abundant liquidity in Hong Kong, but the magnitude will likely be to a much smaller extent than during QE1 where capital inflows amounted to HK$650bn. We forecast system deposit growth of 8-9% in FY12-14E."

Advertise

Advertise