Fasset superapp aims to use digital assets to drive financial inclusion

The digital asset company plans to eventually offer remittance, lending, and borrowing.

Digital asset company Fasset has launched a superapp aimed at making digital assets more accessible as a means to push for financial inclusion.

The Fasset superapp has secured 1 million sign ups in the first week, with Indonesia, Pakistan, and Turkey being the top three markets, the company revealed in a press release.

Fasset had recently secured a crypto asset trading license from Indonesia in May, and said that it is targeting to serve over half of Indonesia’s 270 million people who still lack full access to traditional financial services.

Fasset has also secured licenses in Turkey and the EU and said that it is in the final stages of receiving permissions “from a number of other jurisdictions.”

ALSO READ: Fintech funding slows to 10-year low as investors tout quality over quantity

The launch of its super app kickstart’s Fasset’s goal of becoming the “beginning and end points of some of the world’s top remittance corridors.”

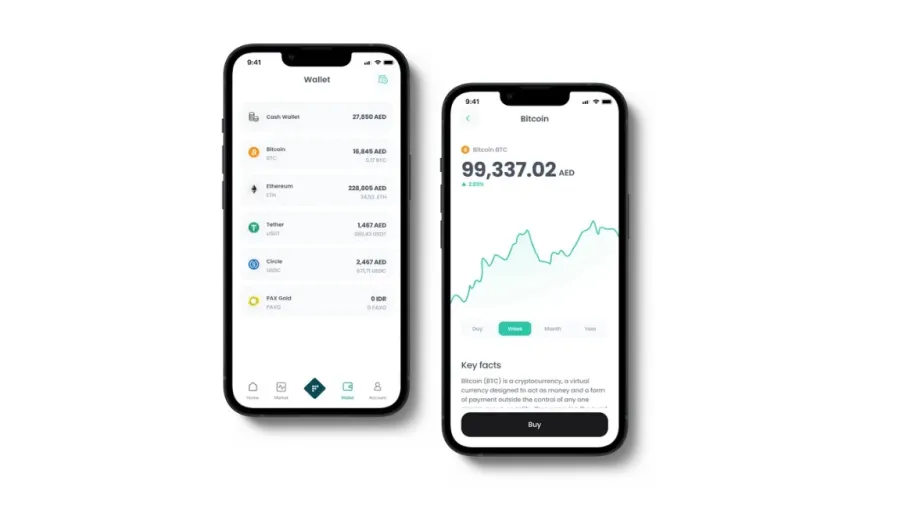

The superapp platform provides an interface through which users can buy, sell, swap, and earn across digital assets – including Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), USD Tether (USDT), PAX Gold (PAXG) and Tether Gold (XAUT).

It will soon offer other asset classes such as tokenized real estate, sukuk and global stocks, Fasset said. It also plans to soon enable services such as remittance, lending and borrowing.

The app also offers customers access to thematic bundles consisting of a variety of digital assets to further make it easier to invest and build long term wealth.

Advertise

Advertise