More News

Making sense of the big picture behind big data in retail

Making sense of the big picture behind big data in retail

Retailers today have access to consumer data more than ever before, such as shoppers’ demographics, preferences, transaction details and purchase history. Muneerah Bee discovers how big data and analysis can help retailers identify what customers are looking for.

How retailers must respond to the changing power dynamic with their customers

In retailing days of the past, customers had access to a limited range of products, sold in specialist outlets, often in just some select locations. Shopping was more about needs, and less about wants. Control lay with the retailer, from availability to pricing.

Unboxing a new retail concept

Everyone loves a surprise in the mailbox. The boom in e-commerce has made online subscription services sprout all over Asia to offer customers almost everything under the sun. Muneerah Bee unpacks the mystery and appeal behind subscription boxes.

Verifone, Ezetap partner to accelerate end-to-end digital payment solutions for merchants

To meet the needs of the rapidly evolving and growing payments technology landscape in India, payments and commerce solutions provider Verifone and software and payment processing provider Ezetap recently announced a partnership to enable merchants to adopt in-store and online payment acceptance more quickly and easily.

Omni-channel platform for global pre-owned luxury network established

The founders of SnobSwap, an online pre-owned luxury consignment platform, recently announced the launch of their rebranded site now called LePrix.com.

Kerry opens Asia's first Centre of Excellence for Meat

Ingredients and flavours manufacturer Kerry announced last month the opening of its expanded Regional Development and Application Centre that is also designated as the first Centre of Excellence for Meat in Bangpoo, Thailand.

Giving merchants direct access to the world's most popular marketplace

Cloud commerce innovation provider Magento Commerce recently announced the addition of sales channel capabilities, so that merchants can more simply and cost-effectively manage inventory on Amazon directly from Magento Commerce.

Voice-controlled logistics management has arrived

Logistics management software provider LogiNext has launched its voice-controlled automation feature as it integrates with Alexa, Siri, Google Assistant and Cortana.

Singapore's Century Square to house a virtual library

Property manager AsiaMalls Management has signed a memorandum of understanding with Singapore’s National Library Board to provide a virtual library of e-books through a digital wall. This initiative will be available at the newly refurbished Century Square mall, which will reopen to the public in Q2 2018.

Mango continues expansion in the Middle East

Spanish clothing design and manufacturing company Mango continues to develop its sales network in the Middle East as the firm closed 2017 with 24 new stores in countries including Saudi Arabia, Israel, Iran and Qatar, reaching a total of nearly 160 stores.

CapitaLand sets world record for Raffles City Chongqing

Singapore-based real estate company CapitaLand has written a new world record as it embarks on the complex crowning process for Raffles City Chongqing, the 1.12 million-sqm urban district located on Chongqing’s famed Chaotianmen riverfront.

UNCTAD, Alibaba Business School kick off eFounders Initiative for Asian entrepreneurs

The United Nations Conference on Trade and Development (UNCTAD) and Alibaba Business School recently enrolled the first class of 37 Asian entrepreneurs for the eFounders Initiative at an opening ceremony held on the Alibaba campus in Hangzhou, China.

Shoppers want technology-enabled experience: study

Heightened customer expectations for delivery are transforming the retail landscape. According to the10th Retail Shopper Study whitepaper by Zebra Technologies, 69% of shoppers in Asia-Pacific expect next-day or same-day delivery. However, 27% of shoppers are not willing to pay for shipping at any speed.

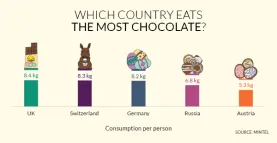

Global Easter chocolate launches up 23% in 2017

When it comes to chocolate eggs, bunnies and other treats it seems there has never been so much choice for chocolate lovers around the world.

New vending machine exchanges recycled plastics, cans for gold

Malaysians will soon be able to earn gold by recycling their plastic bottles and aluminium cans.

35,000 North American merchants now accept Alipay

Alipay, a digital payment platform operated by Ant Financial Services Group and commerce-enabling technology provider First Data, recently announced an expanded partnership that adds 35,000 merchants to the growing roster of businesses accepting Alipay in store.

Barnes & Noble announces new book club in stores

Retail bookseller Barnes & Noble recently announced the launch of the Barnes & Noble Book Club -- a national book club designed to bring readers in communities across the US together to discuss some of the greatest books being published.

Advertise

Advertise