Strong industrial sector brings robust capital to Taiwanese banks

Current lower-for-longer interest rates will support fragile profits.

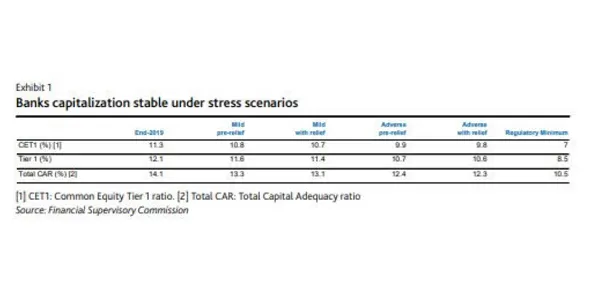

Taiwanese banks’ capital remains sturdy in stress tests administered by the country’s Financial Supervisory Commission on the back of a strong industrial sector which positions the country for substantial global demand, according to a Moody’s report.

The latest stress was based on the banks’ self-defined stress scenarios, taking into account economic and financial shocks caused by the pandemic. Relying on the assessment of the impact from related relief measures, it looks like banks’ capitalisation would remain resilient, the report said.

The results are in line with Moody’s own assessment of rated banks’ Q1 results, in particular the view that current lower-for-longer interest rates will support continued fragility in profitability and will cut loan losses.

On the other hand, loan growth will remain subtle despite some credit demands from reshoring of production sites by Taiwanese manufacturers. This will help keep capitalisation mainly stable in the coming 12-18 months even with a sluggish slower pace of internal capital generation from lower profitability, Moody’s said.

Advertise

Advertise