South Korea

Instant coffee to boost South Korea’s hot drinks market

Instant coffee to boost South Korea’s hot drinks market

It is projected to be valued at $5b in 2026.

South Korea’s retail sales grow by 9.7% in July

This is due to the increase in outdoor activities.

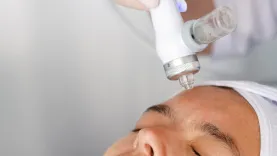

South Korea wins race in aesthethic market: report

The market is expected to grow 7% annually between 2022 and 2030.

South Korea’s convenience stores bring out rare gift sets for Chuseok

These gifts include high-end liquor sets, electric vehicles, and electronics.

Consumer spending in South Korea to grow 2.8% in 2022

Household spending is expected to reach KRW793.9t during the year.

Market Kurly rolls out products in Singapore with RedMart

The brand store mostly offers Korean snacks such as tteokbokki.

Korea retail sales rises 9.3% in H1 2022

Offline and online retailers saw an 8.4% and 10.3% growth, respectively.

South Korea’s Fresheasy to launch products in Singapore online

The company plans to expand sales in Southeast Asia.

South Korea’s retail sales up 10.1% YoY in May

Sales in department stores and convenience stores rose as social distancing is lifted.

Paris Baguette operator buys full stake in restaurant chain Lina’s

SPC Group plans to expand Lina’s presence to North America and Southeast Asia.

South Korea’s GS25 donates inventory of closed stores

The inventory was sent to a rehabilitation facility for PWDs.

South Korea’s skincare market to reach $11.4b by 2026

This is up from $8.5b in 2021 projected by GlobalData.

South Korea consumer spending to grow 2.8% in 2022: Fitch

Real household spending for 2022 will exceeds pre-pandemic levels.

CU adds nine payment options for SEA customers

This came as CU saw its foreign customers rising back to pre-pandemic levels.

Starbucks Korea opens first subway store in Seoul

It does not have plans to expand to more underground locations.

South Korea’s retail sales grow 10.6% YoY in April

Online and offline retailers posted 11%, and 10.2% growth, respectively.

South Korean retailers expand entertainment space on-site

A Lotte Mart outlet opened a futsal court, whilst a Homeplus store built a swimming pool.

Advertise

Advertise