Singapore

Changi Airport's retail hub entices travellers

Changi Airport's retail hub entices travellers

Airports have increasingly become mega retail hubs across the globe and, today, are retail and lifestyle destinations in their own right. Vanessa Ching speaks with Teo Chew Hoon, senior vice-president, airside concessions division, Changi Airport Group, to find out more.

Thriving F&B markets to be showcased at Food&HotelAsia2016

Singapore – Capturing opportunities in Asia-Pacific, positioning Singapore as a compelling marketplace, and building strong value propositions for global markets: These are the government’s key priorities in food, according to Lee Yee Fung, group director, Lifestyle Business Group, International Enterprise (IE) Singapore.

Using meaningful innovation to improve cancer treatment

Article by Abhi Chakrabarti, Director, Global Marketing, Philips Radiation Oncology SystemsHow intelligent automation can reduce patients’ anxiety and create better radiation therapy plansOf all the intruders in a household, cancer is certainly considered one of the most frightening. That said, the management of cancer has improved tremendously over the last decade. Innovative technology helps with early diagnosis, and a range of treatment options, such as radiation therapy, increasingly target the disease and spare healthy tissue, improving the chances of a cure and a better quality of life for many patients worldwide. Yet more needs to be done, and we at Philips are busy making an impact in the fight against cancer on all fronts, from prevention to diagnosis to treatment and home care – something that we call ‘the health continuum.’ One area of focus is radiation therapy, which uses high-energy particles or waves to destroy or damage cancer cells. It is one of the most common treatments for cancer, either by itself or along with other forms of treatment, according to the American Cancer Society. This field has seen a lot of development in recent years, as sophisticated imaging and software has allowed the clinical team to create high quality treatment plans to hit the tumor and avoid healthy cells as much as possible. Treatment delivery devices, such as the Linear Accelerator or LINAC, can now deliver the radiation precisely in many ways, personalized to that individual, as determined by the treatment plan. The treatment itself, performed on an outpatient basis, takes several weeks, and the very fact that the use of radiotherapy is increasing suggests that this treatment technique is providing high quality results.Seeing the Cancer Journey Through a Patient’s EyesAt the outset, it seems that we’ve addressed all the problems and everything is fine. But that’s not the whole story. And this becomes evident when we see the journey through the eyes of a patient.There’s a lot of uncertainty, worrying and waiting involved for the first appointment with the oncologist. During this consultation, the oncologist will describe to the patient a typical treatment course and will try to allay their concerns. Following that, there’s often several days of waiting for the CT scan, also known as a simulation scan. The images of this CT scan, along with other images acquired from MR or PET/CT scanners during diagnosis, will then be used to create an individualized treatment plan. The planning process is time-consuming, often taking several days; labor-intensive because of the significant amount of manual work involved; and generates treatment plans, the quality of which are heavily dependent on the skill of the planner. The treatment plan plays a big role in determining the quality of the treatment itself. For most patients, this means waiting for a week, or more, after their simulation scan to start their treatment, increasing their anxiety and, in many cases, adversely affecting their health further through lack of appetite or sleep. In some instances, the patient might be forced to travel long distances to a specialized cancer center for their four- to six-week treatment, incurring more delays and more costs.Our aim at Philips is to change this paradigm. Meaningful Innovation to Improve Cancer TreatmentClearly, there’s no way to remove all of the anxiety that comes with the word ‘cancer.’ But we are committed to reducing it wherever we can through meaningful innovation. We are introducing intelligent automation in all our imaging devices and treatment planning software to make the process much less labor-intensive, so all the work can be done quicker and less operator-dependent, meaning the quality of the treatment plan will be less dependent solely on the skill of the planner. By removing much of the repetitive work and offering high quality plans, these systems will now enable the highly skilled staff in a radiation therapy department to focus on key tasks that really require their undivided attention. Furthermore, we are integrating much of the functionality between these devices to make the whole process simpler and faster from start to finish. It is easy to see how this has the potential to increase the efficiency of a busy department and give them the tools to improve their quality of treatments. But what about patients and their families? Will they be affected by this change in paradigm? Absolutely. Reducing the time between simulation and start of treatment has huge implications for the patients and their families. Consider the scenario where patients no longer just go home and wait for a week after their simulation scan. Instead, almost immediately after they’ve had the simulation scan they could see their oncologist who would review with them their own personalized treatment plan. Moreover, they might not have to wait an entire week to get their treatment started. This could start within a day or two after the simulation scan – possibly even the same day! In many instances, they might no longer be forced to travel long distances for their treatment because their local cancer center has the technology to offer them world-class treatments. These are not minor changes for the patient. They make a world of difference to their well-being. And all this can be enabled through intelligent automation and integration of devices, something we’re committed to in Philips. Now that is meaningful innovation.Learn more about Philips’ radiation oncology solutions.About Abhi Chakrabarti: Abhi Chakrabarti is the Director of Marketing at Philips Radiation Oncology Systems. He has been involved in various functions, from service to applications to sales and marketing, within the radiotherapy industry over the last 20 years. He holds a masters and doctorate in electrical and electronic engineering.

International Home + Housewares Show 2016 – It's smART!

The International Home + Housewares Show will make its comeback this year with a new branding focusing on an “It’s smART” theme. The show is slated to be the destination for smart, innovative houseware sourcing and the number one industry event in the world to find one-of-a-kind ideas and gain strategic houseware industry insight.

FHA2016 International Conference to broach key trends in APAC

According to the United Nations World Tourism Organisation’s (UNWTO) forecasts, between 2010 and 2030, an additional 43 million international tourists will enter the marketplace every year. And according to the Cushman & Wakefield’s Hotel Views 2015 report, in the first eight months of 2014, the Asia-Pacific region saw 5% more international tourists over the same period in 2013, with an excess of 1.1 billion visitors expected by the end of 2014. The South-Asian sub-region experienced impressive growth on par with North America at 8%.

Fashion retail technology and augmented reality getting fashionable

Customers are always seeking out the ultimate brand experience and many brands and retailers are still trying to figure out their path, or lacking in effort. With augmented reality, visual search and new retail technologies in the picture, the innovative retailer who dares to experiment and can cast an eye to the future will win.

UnionPay expands in Asia

UnionPay, a leading card payment brand from China is expanding its sights for fast expansion in Asia, and internationally. After 13 years of development, the global UnionPay card acceptance network has extended to more than 150 countries and regions, with over 26 million merchants and 1.9 million ATMs worldwide accepting UnionPay cards.

E-commerce shopping fever heats up in Asia-Pacific

With a high number of mobile users and rising middle classes in China, India and Indonesia, the Asia-Pacific (APAC) e-commerce market is surging to become, for the first time, the largest digital retail market in the world — and growing 10% faster than the worldwide average rate. APAC retail e-commerce sales is anticipated to increase to 20.4% of total APAC retail sales by 2019 from 10.2% last year. This is in comparison to a projected 12.8% worldwide average for 2019 from 7.4% in 2015.

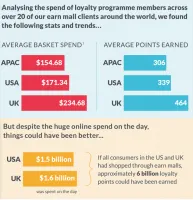

CONTINUOUS SALES … Why Black Friday was a missed opportunity for online loyalty programmes

The traditional Christmas holiday period is Singapore’s main shopping event, but US-style discount days such as Black Friday are beginning to gain traction.

CONTINUOUS SALES … Undesirable & unsustainable business strategy

Black Friday, Singles Day and numerous pre- and post-Christmas sales in the last quarter of each year offer shoppers great year-end deals as well as opportunities for retailers to off-load their inventory.

Singapore commuters shop at Guardian's virtual pop-up store

During the 2015 year-end festive season, Guardian Health & Beauty set up an experimental pop-up store in Singapore which allowed local commuters to shop and pick up gifts on their commute home.

FairPrice launches disabled-friendly store

Singapore's NTUC FairPrice’s newest supermarket outlet in the Enabling Village, an integrated community space for people with disabilities, is designed for the convenience of shoppers with disabilities or ageing.

Clean Clothes Campaign advocating minimum wage standard in Cambodia

The Clean Clothes Campaign (CCC), is advocating a minimum wage rise in Cambodia, targeting the world’s large fashion brands such as H&M, Inditex, Levi’s and Gap.

Changi Airport crowns 52-year-old Irish woman as its newest millionaire

Changi Airport crowned a 52-year-old Irish woman the winner of its “Be a Changi Millionaire” draw held at Terminal 3 last month. Linda Tobin beat six other finalists — three Singaporeans, one Indonesian, one Malaysian and one Briton — to take home the grand prize of S$1 million (US$700,000).

Advertise

Advertise