Japan

Japanese banks foray into big data through personal info brokering

Sumitomo Mitsui Trustbank received approval to operate an information bank. Japanese banks are entering a new era as they go into personal info brokering, The Asahi Shimbun reports. The government-backed Japan Federation of IT Associations has given the green light for Sumitomo Mitsui Trustbank and Felica Pocket Marketing, a subsidiary of retailer Aeon Co., to operate a data brokerage service that will allow them to establish an information bank that will buy and sell customers' personal data. Under the service, the company will receive data from customers such as their name, purchase history and health-related information, in trust. Upon customer consent, the bank will provide data to companies that are eyeing to develop new products. Similar to the bank's practice of paying interest on a deposit, customers who shared their information will be compensated with cash, coupons or bank services.

Japanese banks foray into big data through personal info brokering

Sumitomo Mitsui Trustbank received approval to operate an information bank. Japanese banks are entering a new era as they go into personal info brokering, The Asahi Shimbun reports. The government-backed Japan Federation of IT Associations has given the green light for Sumitomo Mitsui Trustbank and Felica Pocket Marketing, a subsidiary of retailer Aeon Co., to operate a data brokerage service that will allow them to establish an information bank that will buy and sell customers' personal data. Under the service, the company will receive data from customers such as their name, purchase history and health-related information, in trust. Upon customer consent, the bank will provide data to companies that are eyeing to develop new products. Similar to the bank's practice of paying interest on a deposit, customers who shared their information will be compensated with cash, coupons or bank services.

Japan's regional banks cash in on middle-risk loans

The share of real estate in total loans hit a record high 16%, thanks to regional lenders. Regional banks in Japan have been boosting their exposure to firms with higher credit risks and to the real estate sector as they battle against declines in domestic loan yields, Moody’s said in a report. As a result, regional banks have been leading systemwide loan growth, boosting loans faster than deposits. “Some regional banks' strategy is to boost what they classify as ‘middle-risk’ loans to small and medium-sized enterprises (SMEs) that rank on the lower end of creditworthiness,” the report said.

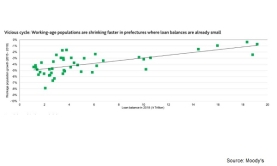

Chart of the Week: Here's where Japanese banks' shrinking loan balances are hitting harder

More than half of lenders based in Chugoku, Koshinetsu, Shikoku and Tohoku earned less revenue.

Visa and LINE Pay teams up to advance mobile payments

It will allow LINE Pay users to transact at over 54 million Visa merchant locations. Visa and LINE Pay will team up to create new financial services experience for their collective user bases of millions of consumers and merchants worldwide. In consumer payments area, active users of LINE will be able to apply for a digital Visa card from within the LINE app, and over time, add any of their existing Visa cards to make payments from their mobile phone. The companies will also offer users additional and enhanced experiences like integrated loyalty programmes and tailored offers and new payment capabilities for users when they travel overseas. The partnership will also allow LINE Pay users to use LINE Pay at Visa’s 54 million merchant locations. These transactions can be viewed through their LINE Pay digital wallet, even where LINE Pay is not directly accepted. Additionally, the team will develop new experiences based on blockchain that enable B2B and cross-border payments and alternative currency transactions and will partner on exclusive marketing campaigns and promotions to contribute to Japan’s acceleration towards a cashless society in the lead-up to and after the Olympic Games. The Visa co-brand programme currently serves 2.3 million customers in Taiwan, and will be launched later in 2019 in Japan.

Japanese lenders team up with global banks for blockchain-based digital coin

It will be used to speed up overseas money transfers.

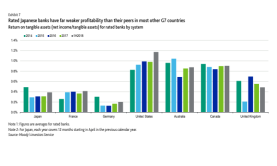

Chart of the Day: Japan banks' profitability still lag behind G7 peers

The sector’s return on assets hit 0.4% in H1 2018, below 1.2% in the US and over 0.8% in Australia. This chart from Moody’s Investors Service shows that although the average return on assets (ROA) of rated Japanese banks rose to around 0.4% in the first six months of 2018, the sector’s profitability remained far below that of banks in most other G7 countries such as the United States, Australia, Canada and the UK. Also read: Japanese banks hit by lower net interest income as loan demand dwindles

MUFG to close 80 more branches

The move aims to cut costs and boost efficiency gains.

Mitsubishi UFJ Financial Group to cease coal financing

The banking group added forestry, palm oil and coal mining to its restricted transactions list.

Japanese megabanks' annual profits fall as ultra-low rates take toll

Mizuho's profits plunged 83% to $877m.

Japanese megabanks still reeling from lower net income

Sumitomo Mitsui projects a net income decrease of 4% to $6.39b in 2019. Bloomberg reported that Japanese megabanks are bracing for another tough year ahead of weakening net income amidst the weakening economy, rising trade tensions, and the sustained monetary easing from the central bank. Also read: Japanese bank woes to persist as ultra-low rates to last until 2020 Whilst both Mizuho and MUFG are expecting profit to increase this year, to $4.3b (JPY470b) and $8.22 (JPY900b),respectively, that’s only after they booked large writedowns that hurt results in the previous period. Meanwhile, Sumitomo Mitsui sees net income slipping about 4% to $6.39b (JPY700b). Net income projections from Sumitomo Mitsui Financial Group (SMFG), Mitsubishi UFJ Financial Group, and Mizuho Financial Group have all missed analysts estimates amidst rising bad loan costs and lesser gains from sales of stock holdings, which used to be its saving grace amidst rock-bottom interest rates. Also read: Japanese banks hit by lower net interest income as loan demand dwindles

Japan Kicks Off Reiwa Era's Payment Infrastructure - Part 1: Zengin

In November 2018, the Japanese Bankers Association and Zengin Net launched a new platform—the so-called “more time system.” This extends the operation hours of the Zengin System, the backbone of the nation’s bank payment infrastructure, extending the service hours of financial services related to fund transfers. As a result, together the existing and new system will enable round-the-clock operations 365 days a year, making it possible to confirm the receipt of funds from other banks in real time.

Japanese bank woes to persist as ultra-low rates to last until 2020

The negative rates will continue to eat away at profitability.

Chart of the Week: Japanese banks' real estate loans hit record high as risk appetite grows

Loans to the real estate sector as a share of GDP hit 14.4% in late 2018.

JPMorgan appoints Takenori Yoneda as head of corporate banking

Ha started his stint in the bank back in 2011.

700 banks to join Japan's nationwide smartphone payment service

It will launch in October which coincides with the October consumption tax hike.

Japanese megabanks curb hiring amidst digitalisation drive

MUFG will cut new hires by 45% as it aims to halve the number of teller-operated branches.

Payment apps make headway in cash-heavy Japan

Fintech firm PayPay is setting aside $91m of reward points to incentivise usage.

Advertise

Advertise