Hong Kong

These factors are weighing on Hong Kong banks' credit profiles

Rising private sector debt is one key risk.

These factors are weighing on Hong Kong banks' credit profiles

Rising private sector debt is one key risk.

PayCommerce's Abdul Naushad to discuss the evolution in the payments space

He will talk about the next generation in global transaction banking at the 2017 Banking Forum.

BOCOM International's Hao Hong to be one of the panelists at the 2017 Banking Forum

He will join the discussion about banks and fintechs.

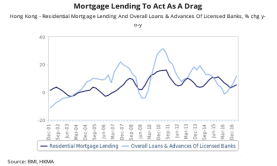

Chart of the Week: Hong Kong banks' mortgage lending to slow

Rising interest rates are to blame.

Three in five banks report trade finance shortage in the global market

The estimated trade finance gap stands at US$1.6t.

Citi Asia's revenue grows 4% to US$3.4b in Q2

This was the fourth consecutive quarter of revenue growth year on year for Citi in Asia. Last Friday Citi globally reported 2Q results – with US$17.9bn of revenues and US$3.9bn of net income. Asia was a strong contributor to these results, with broad based growth and revenue of US$3.4bn up 4% year on year. A standout performer was Citi’s consumer bank in the region. Citi’s consumer business grew revenues by 4% during the quarter to US$1.8bn with profit up 9% year on year and 31% versus the previous quarter. Asia contributed nearly a third of all the profit generated by the bank’s consumer business in the second quarter.

Hang Seng Bank's John Wong to discuss the need to digitalise banks' operational needs

He will be one of the panelists at the 2017 Banking Forum in Hong Kong. John Wong, head of global liquidity and cash management at Hang Seng Bank, has over 28 years’ experience in transaction banking. He has responsibilities across sales, product management, digital banking channel development, and client implementation. Wong has a proven track record in delivering strong and sustainable business results and has thorough knowledge on the commercial banking sectors. He possesses strong leadership and good stakeholders management skills. He has a successful career span in business transformation and managing changes effectively with multi-cultural appreciation in working with people of different nationalities and background. He worked in Standard Chartered Bank for 25 years prior to moving to his current role in Hang Seng Bank. Wong will be one of the panelists who will discuss Digital Banking vs Physical Branches at the 2017 Banking Forum in Hong Kong. What are your previous experiences and positions held that contributed to who you are as a banker/financial services expert today? My diverse background from sales and marketing, product development, electronic channel innovation and client implementation and management help me to understand our customer needs from end to end. My experience in the Hong Kong and China markets also help me to appreciate the cultural differences of customers in different continents, and to come up with solutions that best serve their needs. What are your key business philosophies? To provide a solution which addresses customer needs, rather than product driven sales. To establish long term partnerships with mutual benefits to both the customer and the bank Can you give us a glimpse of what you will share at the panel discussion at the Banking Forum in Hong Kong? What can you say about the impact of digital banking on physical bank branches in Hong Kong and in the region? The role of the branch to change from servicing into advisory. Routine day to day operational needs to be moving into digital channel gradually.

Esmond Lee of Hong Kong's Financial Services Development Council to sit as a panelist at the 2017 Banking Forum

He says the cross border payments in the foreseeable future will still be served by banks.

Celent's Eiichiro Yanagawa to talk about a holistic framework for digital in banking

He will discuss the lack of consensus on digital at the 2017 Banking Forum in Hong Kong.

Learn more about Hong Kong's real-time payments market from Hang Seng Bank's Stéphan Levieux

He will be one of the panelists at the 2017 Banking Forum in Hong Kong.

Catch Simon Leung of China CITIC Bank International at the 2017 Banking Forum in Hong Kong

He will join the panel discussion on banks and fintechs.

Hear from EY's Keith Lin as he talks about fintechs and the digital banking landscape

He will also join the panel discussion on the impact of digital banking on physical bank branches at the 2017 Banking Forum.

ICBC Asia's COO to discuss how third party payment providers threaten traditional banks at the 2017 Banking Forum in Hong Kong

Jimmy Chan says real-time cross-border payment progresses in line with the international development of e-commerce. Jimmy Chan, chief operation officer and head of operation management department at ICBC (Asia), has over 30 years of experience in major international banks including The Chase Manhattan Bank, ABN-AMRO Bank, OCBC Bank, CITIC Industrial Bank (China), CITIC Bank International, DBS Bank, and ICBC (Asia) Ltd. He currently serves as a member of various committees at the Hong Kong Association of Banks: Consultative Council, Financial Services Delivery Channel Committee, and the Consultative Committee on Deposit Protection Scheme. He is also a member of the board of directors of the HKEX-OTC Clearing Limited. Chan will be one of the panelists who will discuss Real-time Cross-Border Payments in Asia at the upcoming Banking Forum 2017 in Hong Kong. Chan believes that the cross border real time payment is actually developed in line with the international e-commerce development. He says it was originated from the USA with gurus like eBay, Amazon. “When they sell products over the internet, a real time cross border payment mechanism has been evolving to satisfy the need for immediate clearance and settlement against product delivery. The application is further enhanced by the Chinese market and has since developed into even more powerful platform and much bigger market, like the Alipay from TaoBao and the Wechat Pay from Tencent. This development poses a threat to commercial bank which is the traditional provider of cross border remittance product. The Forum can discuss on the relationship between traditional banks and these third party payment providers, competition and cooperation,” he adds. The 2017 Banking Forum will be held on July 26 at the Conrad Hong Kong.

Bain & Company's Priscilla Dell'Orto to speak about customer loyalty and digitalisation trends in banking

She will be one of the speakers at the 2017 Banking Forum in Hong Kong on July 26. Priscilla Dell’Orto is a principal in Bain & Company’s Hong Kong office. She is also a leader in Bain’s global Financial Services and Customer Strategy & Marketing practices. She has deep experience with customer loyalty and the Net Promoter System (NPS) across a number of industries in Asia, with a focus on retail banking and insurance. She is actively involved in the development of Bain’s next generation NPS tools. Dell’Orto earned an MBA from NYU Stern School of Business. She is a graduate of Università Commerciale Luigi Bocconi, Milan, where she received her BA in International Economics and Management. Dell’Orto will be one of the speakers at the upcoming Banking Forum 2017 in Hong Kong. She will be talking about Loyalty in Banking in an Increasingly Digital World. Find out more about her in this short Q&A: What are your previous experiences and positions held that contributed to who you are as a banking expert today? As a Principal at Bain & Company I’ve primarily focused on the Financial Services industry. Over the past 8 years I have advised a number of Financial Services clients globally – including banks – helping them to address some of their toughest business challenges related to strategy, customer experience and loyalty, IT and digitalization, performance improvement, organisational redesign, and change management.

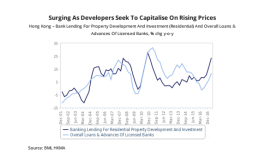

Chart of the Week: Check out Hong Kong banks' growing exposure to the property sector

Direct lending by banks to developers increased 23.6% in March.

All you need to know about the newly launched FinTech Association of Hong Kong

It is led by 12 committees, each dedicated to a particular branch of FinTech. The FinTech Association of Hong Kong (FTAHK) was officially launched on June 27 in an event that was attended by over 300 guests from across the local FinTech community and other industries.

AI, robotics to drive Hong Kong banks' growth

But risk and regulation will remain a key focus.

Advertise

Advertise