Hong Kong

Hang Seng Bank unveils 1-year fixed-rate mortgage plan

It offers a rate of 1.68% per annum.

Hang Seng Bank unveils 1-year fixed-rate mortgage plan

It offers a rate of 1.68% per annum.

Big Hong Kong banks lock mortgage rates amidst Fed hike worries

HSBC and BOC locked their rates at 1.68% which is lower than the industry standard of 2.15%.

SFC slaps Credit Suisse with $39.3m penalty

The bank self-reported its various internal control and systems failures to the regulator.

Hong Kong banks may need to lift deposit and interbank lending rates

No thanks to higher funding required for retail deposits.

Deustche Bank appoints Aleksandar Pfajfer as managing director, head of lending & deposits in APAC

It also names Tony Tan as director, head of strategic lending in Asia and head of lending Southeast Asia and South Asia.

Hong Kong banks to benefit from HKMA's proposed loss-absorbing capacity rules

These will facilitate loss absorption and recapitalization in case of bank failure.

Standard Chartered unveils mortgage plan with fixed rate

The plan has a fixed rate of 1.68% p.a. for the first year.

Standard Chartered appoints Andrew Au as regional head for Greater China and North Asia

He was previously Citi's CEO for China.

Hang Seng Bank's mobile branch goes to remote areas

It provides general banking services to public housing residents.

Hong Kong banks' loan growth predicted to hit 18% for 2018

The forecast rose from 7.5% as lending to private companies grew.

Hang Seng Bank unveils AI chatbots for retail banking

Chatbots ‘HARO’ and ‘DORI’ are now ready to serve. Hang Seng banks spearheads the use of artificial intelligence (AI) technologies for retail banking services in Hong Kong with the launch of their two chatbots, HARO and DORI. Using AI technologies including machine learning and natural language processing, the two virtual assistants are able to simulate human-like contextual conversations and interact with customers. They can communicate in Chinese and English, and can also understand Cantonese as well as the mixing of English and Chinese. Through interacting with customers, HARO and DORI will continuously improve their ability to address customer enquiries. Reflecting the service objectives of ‘Helpful; Attentive; Responsive; Omni’, HARO will be available through hangseng.com and the Hang Seng Personal Banking mobile app from 10 January 2018. Covering the Bank’s mortgage, personal loan, credit card, medical insurance and travel insurance services, HARO will handle general enquiries about the products and services, help customers identify suitable products and provide application information. HARO can also assist customers with calculating repayment amounts for designated personal and mortgage loans. DORI (‘Dining; Offers; Rewards; Interactive’) will be launched on 11 January 2018. Available through Facebook Messenger, DORI can search and suggest credit card merchant discounts, and dining and online store offers that suit the personal preferences and lifestyles of customers. DORI can also make reservations for customers at selected restaurants. Additional features will be added to the service scope of HARO and DORI in 2018.

Can AI and Sentiment Analysis provide the edge that your Finance company needs to surge ahead of the competition?

Major conference on AI and Sentiment Analysis in Finance, Hong Kong, 7-8 March 2018.

How Hong Kong banks can fight financial crime in 2018

Banks will continue to develop the use of technology and data analytics for AML.

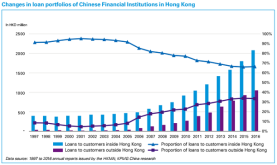

Chart of the Week: See how the loan portfolios of Chinese banks in Hong Kong changed since 1997

Their portfolios are becoming more global.

Almost half of Chinese banks in Hong Kong to focus on RMB internationalisation in 2018

Hong Kong will be the first and biggest beneficiary of the trend.

Citi Private Bank reveals key appointments in Asia Pacific

Rudolf Hitsch has been appointed North Asia head, Jyrki Rauhio as South Asia head, and Akbar Shah as head of business development at Citi Private Bank.

Banks urged to brace for geopolitical and regulatory tensions in 2018

Banks also need to prepare for increased competition from non-traditional players.

Advertise

Advertise