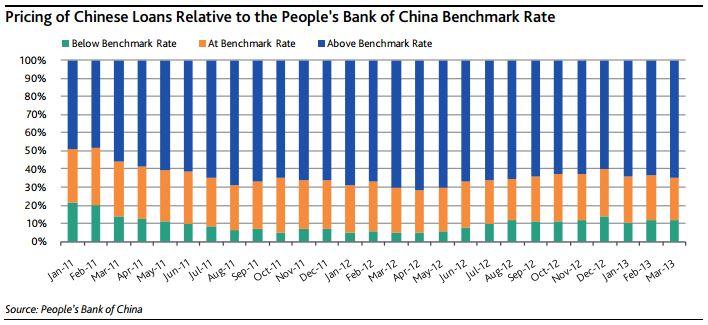

Only a small portion of China banks' new loans priced below PBOC's benchmark rates

Most banks expected to retain their pricing power.

According to Moody's, the People’s Bank of China (PBOC), China’s central bank, removed the regulated floor for lending rates, allowing financial institutions to set their own rates on all loans except mortgage loans, whichwill remain subject to the existing floor.

Although the removal of the lending rate floor is an important step in China’s reform of its financial system, the PBOC’s action is credit negative for Chinese banks because it is another move towards interest rate deregulation that will narrow their net interest margins.

Here's more from Moody's:

Before this announcement, the PBOC controlled China’s lending rates with a floor set at 0.7x the central bank’s benchmark rates. The PBOC still controls deposit rates with a cap of 1.1x benchmark rates.

We expect the removal of the lending rate floor will allow borrowers with strong bargaining power to obtain cheaper funding, thus reducing banks’ profitability.

This will have the largest effect on China’s four largest banks, Industrial & Commercial Bank of China Ltd., China Construction Bank Corporation, Agricultural Bank of China and Bank of China Limited, all of which have relatively large exposures to large state-owned enterprises (SOEs) that could negotiate for lower lending rates.

However, because mortgage loans remain subject to the lending floor and currently only a few large creditworthy state-owned enterprises (SOEs) benefit from lending rates close to the floor, we expect most banks will largely retain their pricing power.

Moreover, our analysis points to Chinese banks’ margins being more sensitive to a liberalization of deposit rates than lending rates

Advertise

Advertise