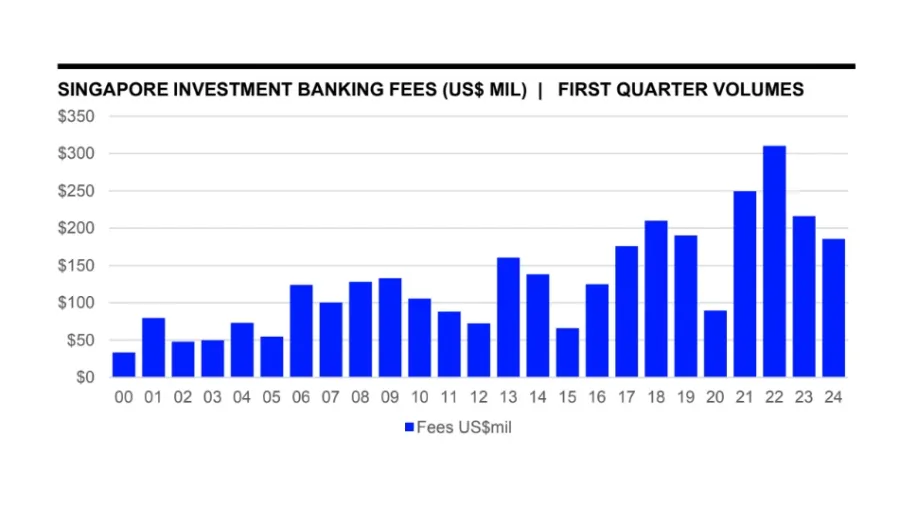

Chart of the Week: Singapore investment banking fees down 14% in Q1

Advisory fees from M&A transactions fell by 74% during the quarter.

Singapore generated an estimated US$185.7m worth of investment banking fees in Q1 2024, 14% lower than the first quarter of 2023, according to data released by the London Stock Exchange Group (LSEG) Data & Analytics.

Equity capital markets underwriting fees total US$11.8m, a 36% decline from a year ago.

Debt capital markets, meanwhile, grew 3% to $20m.

ALSO READ: Empathy deficit erodes customers’ trust in banks

Advisory fees earned from M&A transactions saw the biggest plunge, falling by 74% to $28.3m over the same period.

Syndicated lending fees, meanwhile, rose 86% to $125.6m in the first quarter of 2024.

Amongst banks in the Lion City, DBS took the lead in the investment banking fee league table, clinching 6.7% of the total fee pool or $12.4m.

Advertise

Advertise