Why RMB globalization is still a long way off

By Nathan Chow Hung Lai (周洪禮)Efforts to globalize the renminbi (RMB) reached a milestone when the currency joined the league of the most-traded currencies for the first time.

According to the Bank for International Settlements’ (BIS) latest report on foreign-exchange turnover, daily trading in RMB has tripled over the past three years to USD120 bn. This makes the RMB the ninth most actively traded currency in 2013, with a share of 2.2% in global FX volumes. The RMB ranked 17th (with a share of 0.9%) in the last survey conducted in 2010. The ninth-most-actively-traded currency

The notable improvement highlights the flexibility foreign firms can gain by using RMB. For corporations that trade with China, the use of RMB can lower their FX costs and risks. They can also enjoy the price discounts offered by some mainland companies.

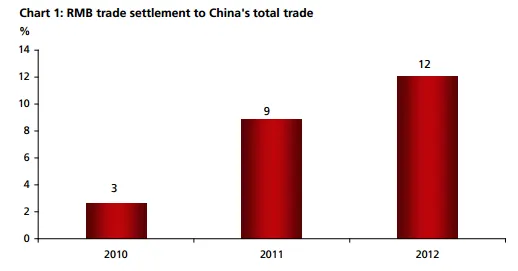

Since Chinese exporters usually raise prices on foreign currency transactions as a cushion for potential FX fluctuations, it is estimated that overseas importers paying in RMB could save 2-3% on their invoices. The combination of factors has led to a six-fold surge in RMB-settled trade in the past three years (Chart 1).

Continuous policy initiatives Having said that, the RMB is still underrepresented when compared to the size of the China’s economy. Currently, China represents around 11% of global GDP (2nd largest economy) and more than 10% of world trade (largest trading country). But the RMB’s share in global FX volumes is significantly lowered than that of the USD (87%), the most-used currency for global transaction (Chart 2).

Continuous efforts are therefore desired to move RMB further up the ranks as a global payments currency. Trade channel In July, the People’s Bank of China (PBoC) announced a series of measures aimed at simplifying RMB cross-border transactions.

Based on the basis of ‘know your customer’, ‘know your business,’ and ‘due diligence’, banks in the mainland can process RMB cross-border trade settlement for their corporate clients before verifying the documentary proof of underlying trade transactions. The streamlined process increases the efficiency in handling RMB-denominated trades.

Meanwhile, the PBoC has also approved a new scheme — gross-in/gross-out arrangement — to make it easier for a European Fortune 500 company with substantial sales in China to manage its RMB holdings.

Before the new model was introduced, the company had to process multiple cross-border RMB payments separately for regulatory oversight, resulting in transaction costs and a lack of central monitoring.

Some domestic banks were also being frustrated since settling trade separately had been both time-consuming and labor intensive. Under the new scheme, the company can consolidate all incoming RMB transactions made in different time periods into a single transaction; as well as all outgoing RMB payments into another.

This centralized approach to cash management significantly reduces the exchange rate exposure and optimizes liquidity management for the company. It also sets a precedent for other foreign corporates to adopt the RMB in international trade.

Portfolio investment channel Progress has also been made on loosening controls on cross-border investment. In August, the State Administration of Foreign Exchange (SAFE) simplified rules on the QDII (Qualified Domestic Institutional Investor) scheme, including allowing investors to choose the currencies they want to use for cross-border fund remittance and no longer requiring the regulator’s approval on FX purchases/sales.

After the deregulation, China fund managers will see more flexibility in designing QDII portfolio. Offshore RMB investable products such as dim sum bonds could also be benefitted.

For instance, mainland investors might be particularly interested in high yield names such as property developers as Chinese property firms have been banned from issuing onshore. Direct investment channel Beijing is also keen to boost offshore RMB liquidity by encouraging more RMB use in outward direct investment (ODI).

On the back of policy relaxation, such as raising thresholds for project amounts subject to approval and simplifying application procedures, RMB-settled ODI surged 50% last year (Chart 3).

The growing share of private investment can also be seen as a result of preferential policy supports. In 2012, outward investment made by non-SOEs accounted for 9.5% of China’s ODI, a significant rise from 4% in 2010.

More encouragingly, the US has recently committed to maintain an open and fair investment environment for Chinese investors. If realized, this represents an important breakthrough for China’s ODI

In the past, Chinese direct investment was often viewed with suspicion because it was dominated by SOEs.

These were considered a threat to competitive markets and, occasionally, to national security. Consequently, though China was the largest investor in developing economies in 2010 and 2011, it represents less than 2% of the US’s total stock of inward investment.

According to the Heritage Foundation, China has ploughed about USD50 billion into the US during 2005-2012. But over USD200 billion-worth of potential deals have fallen through due to political opposition and regulatory obstacles. Political obstacles mainly targeted large M&A deals in sensitive industries, such as oil and gas, infrastructure, and high-tech industries (i.e., CNOOC’s failed bid for Unocal in 2005; Huawei’s unsuccessful attempts to acquire 3Com in 2008 and 3Leaf in 2010).

Apparently, China’s ODI would be greater if the US was to become more hospitable towards mainland investment. This will also facilitate the growth in RMB ODI as the application procedure is virtually the same for RMB-settled and USD-settled investments. Cross-border RMB flows channel As part of the steps toward a convertible RMB, the development of the Qian¬hai economic zone has been emphasized on cross-border RMB flows.

Hereto, fifteen Hong Kong banks were authorized to offer a combined RMB2 bn of loans for Qianhai companies. Such cross-border RMB lending scheme provides Hong Kong banks a new attractive avenue for RMB fund investments; the growth of which has far been lagging behind that of other offshore RMB products.

For instance, the total outstanding RMB loans in Hong Kong merely amounted to RMB88 bn, compared with the dim sum bond mar¬ket’s RMB500 bn (Chart 4). The limited size of RMB-settled business for Hong Kong companies is a major factor that attributes to the weak RMB loan growth, according to a survey constituted to the DBS RMB Index for VVinning Enter¬prises (DRIVE). Cross-border lending is thus essential in improving the demand and yield on the Hong Kong’s RMB deposit; and subsequently the offshore RMB circulation.

In July and August, three land auctions (14 million sq ft GFA) were held in the zone, which signals that Qianhai has already entered into an expansion phase. Given the anticipated surge in business activity, Qianhai has assigned up to 200 million sq ft GFA for office space usage.

Stronger demand for cross-border loans is therefore expected going forward. Conclusion China’s efforts to internationalize the RMB have been warmly welcomed by the corporate sectors and global investors, indicating enormous demand for the RMB as a trade settlement and investment currency.

As such channels broaden and deepen, coupled with the ongoing expansion of offshore RMB hubs, the RMB is set to move up the ranks further as a global currency.

The likelihood of RMB to become one of the top five most traded currencies is high in the next BIS’s report to be published in 2016.

Advertise

Advertise