UNO Digital Bank bags Digital Banking Award - Philippines with its inclusive services

![]() It brought home the ABF Fintech Award 2024 for disrupting the Philippine financial landscape by providing greater inclusivity and accessibility.

It brought home the ABF Fintech Award 2024 for disrupting the Philippine financial landscape by providing greater inclusivity and accessibility.

With its cutting-edge technologies and customer-centric solutions, digital banking company UNO Digital Bank continues to successfully redefine financial services in the Philippines with empowering products and services, as well as its advocacy for financial inclusion and literacy for Filipinos, especially those that remain underserved by traditional banks.

Within 21 months from its commercial launch, the digital bank has amassed over 1.6 million customers with US$118m in deposits and a loan book of over US$29m serving more than 100,000 customers by building a platform from scratch. This result has been bolstered by its products and features such as savings account, bills pay, and debit card, as well as the creation of key loan distribution channels and a fully digital customer journey to make loans accessible on demand.

Amongst its most popular products are the savings account #UNOready, which offers 4.25% per annum interest rate credited daily on deposits of at least PHP5,000, which can come with free life insurance of up to PHP50,000 and its #UNOnow loan, which provides longer repayment terms and higher credit limits. These services have been designed to help the unbanked and underserved address common challenges such as high costs, minimum deposits, and strict Know Your Customer (KYC) requirements.

Furthermore, it has undergone a strategic partnership with mobile wallet app GCash, wherein UNO got to offer banking services directly through the GSave Marketplace and bypass traditional KYC hurdles. The bank has also pioneered time deposits in GSave Marketplace, where customers can earn up to 6% with only PHP5,000 required, much lower than most of its competitors.

Through the partnership with GCash, the entities have been able to reach people in remote and rural areas and help them open bank accounts without the need to travel to urban centres.

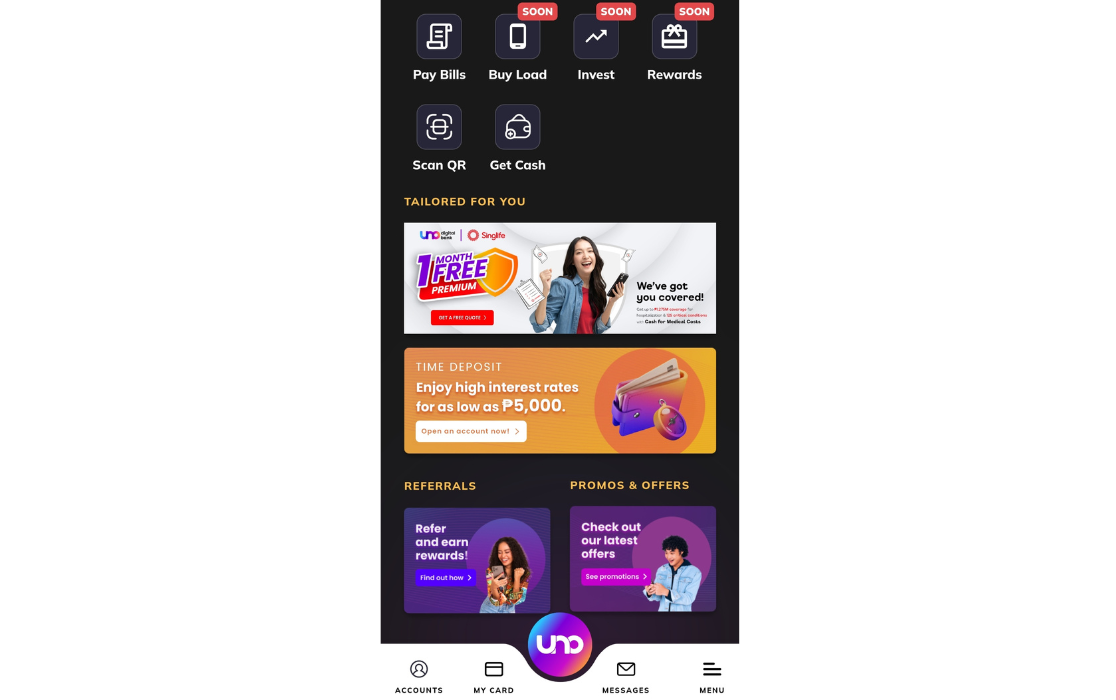

Aside from this venture, it has also collaborated with digital life insurer Singlife to offer customers affordable insurance plans directly through its app. The insurance plans cover hospitalisation, critical illness, accidents, and income loss.

UNO Digital Bank’s customer acquisition rate currently stands at over 100,000 per month due to its strategic partnerships, with 54% of its new accounts coming from non-salaried individuals and 30% of incremental accounts estimated to be from first-time bank account owners.

The bank’s major feats in enabling more accessible and innovative digital banking for Filipinos have been acknowledged by the ABF Fintech Awards, with UNO Digital Bank bagging the Digital Banking Award - Philippines accolade.

“Our rapid growth, innovative approach, commitment to financial inclusion, and that we are continually redefining what a digital bank stands for make us a strong contender,” the company said.

The coveted awards programme recognises the outstanding achievements of companies, ranging from innovative start-ups to established fintech entities and disruptive technological leaders, who are driving impactful advancements in the financial sector.

The ABF Fintech Awards is presented by Asian Banking & Finance Magazine. To view the full list of winners, click here. If you want to join the 2025 awards programme and be acclaimed for your company's impactful contributions to the fintech industry through pioneering solutions and successful deployments, please contact Julie Anne Nuñez at [email protected].

Advertise

Advertise