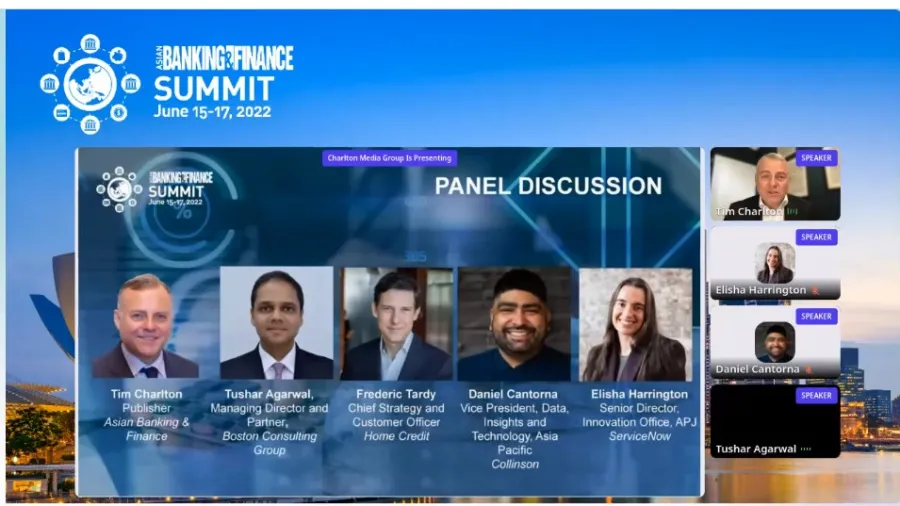

BCG, ServiceNow, Collinson & HomeCredit on why lenders have zoned in on monitoring technology, loyalty as key to future of industry

Technology is very much one if not the most influential factor rapidly transforming the financial services industry, with decentralized finance and buy now pay later being key focus areas, according to the analysts and market leaders taking part in the first panel of the Asian Banking & Finance Summit 2022.

Today, monitoring controls are amongst the biggest focuses of banks today, with lenders using technology to check lending procedures and policies, observed Elisha Harrington, senior director, Innovation Office, APJ for software company ServiceNow. This helps not just to speed up the process, but more so to reduce the overhead and administrative burden on individual teams of the lenders.

“We can check against policies and procedures to ensure that a lot of that lending procedures is done correctly, and prevent a lot of pitfalls that may or may not result in regulatory fines down the track for missed settlement periods,” Harrington told attendees as an example of what type of technologies lenders are implementing.

“We're also seeing more of a focus on a complete, simplified and seamless experience for both the banker, the agents, brokers, and also the customers involved,” Harrington added.

Similar to Harrington, Tushar Agarwal, managing director and partner of the Boston Consulting Group, noted that lenders are upgrading their internal banking processes in order to implement different channels in which loans could come into the bank.

“People are thinking not just of the backend process and re engineering, but also now thinking about new channels that they are now tapping into and how do they make the lending journey a lot more seamless,” Agarwal said.

In order to achieve this, one of the key elements banks are asked to focus on is the user interface of their platforms, according to Daniel Cantorna, vice president, Data, Insights and Technology, Asia Pacific, at Collinson.

Beyond that, Cantorna said that it’s important for banks to focus on keeping customers rather than just onboarding new once. Frictionless services and personalization will be key to doing so. For the former, Cantorna said that Collinson has observed over 1,400 banks globally are working to lessen friction in their lending processes. But for the latter, customers notedly remain unsatisfied, with only 1 in 3 (34%) indicating that they are getting the personalized services they expect—versus the 2 in 3 (66%) that already expect it.

“Often this does come down to varying things, depending on the type of bank that it is in. The in the larger multinational banks are usually [bogged ] by legacy technology, creating silos where experience varies depending on where you are, where you're interacting with the bank, which products you're buying from them,” he said.

This leads to varied customer experiences, sometimes good, sometimes bad. And that can affect loyalty, Cantorna warned, adding, “Getting that consistency across the bigger, the bigger organizations is really critical.”

Apart from internal process and UX, FSIs are also exploring new revenue streams in the form of new types of lending services—with buy now pay later (BNPL) being amongst the hottest. Over 20 million new people yearly are estimated to access financing and credit through the internet, according to Frederic Tardy, chief strategy and customer officer for Home Credit, one of the region’s leading buy now pay later (BNPL) providers.

And with banks in Asia likely to focus on the prime segment, fintechs like Home Credit have a great opportunity to make waves with the middle segment, especially for their rising interest in buy now pay later services.

As for the rising interest rates, Tardy said that this likely will not affect BNPL, but he does expect the rise of online shopping to benefit the BNPL market. These are prominent in segments including telcos, mobile devices, and even car manufacturing, he said.

Interest free products will continue, [and even] retailers and manufacturers are also contributing to pay the cost of the interest [in order to] continue offering BNPL products, Tardy added.

Speaking of technologies, another space that FSIs could explore is the growing decentralized finance space. Banks, in particular, should look into DeFi for the sake of future-proofing their customer base, according to BCG’s Agarwal.

Agarwal shared a recent experience with a startup that BCG worked with. He noted how the younger generation are interested about cryptocurrency and DeFi, with “a clear opinion about what's going on.”

“They really understand the dynamics of the market of all the macroeconomic factors that are impacting the market and how this is good,” Agarwal said.

“For banks, what is interesting is that these are your future customers. So they live and breathe in this space, they understand this very much. And that's actually the key thing that we need to think about. Because these customers, although they're young today, they're going to be in the 30s and 40s, and are gonna be the prime customers,” he explained.

Watch the video below to watch the panel discussion:

Advertise

Advertise