Why Asian banks must beware of the threat posed by Aussie banks

By Martin SmithTransaction Banking in Asia is dominated by the ‘Big Three’ of Standard Chartered, HSBC and Citigroup - however the emergence of ambitious competition from abroad poses distinct challenges to both large and small banks.

Both locally based and international incumbents have invested vast sums of money and time into building strong market share and mind share within highly competitive Asian banking markets.

Seeking greater wallet share advantages via robust customer advocacy and cross sell initiatives, the threat posed by Australian banks committed expansive plans in Asia is not to be taken lightly.

Australian banking investment in Asia has increased over four times since 2008, with tight credit conditions and elevated funding costs driving expansion into emerging and predominantly under banked markets.

Spearheaded by ANZ, the cumulative exposure to the region exceeds $100 billion according to the most recent financial stability review conducted by the Reserve Bank of Australia (RBA).

ANZ’s half yearly results indicated continued guidance towards 30 percent of revenue generation from Asia itself, making clear its intentions for the next five years. ANZ is not alone, with NAB also leveraging upon existing business banking relationships as a foundation on which to build a larger presence in the region.

HSBC and Standard Chartered, much like CBA and Westpac in Australia, operate distinctly different business models but together control the highest profile transaction banking products including account services, cash management, FX and trade finance. HSBC draws strength from its global structure and solidity, while Standard Chartered seeks higher revenue and diversification into new markets.

The question Australian banks must ask themselves is will they be able to compete with purely Asian focused banks, and how can they reposition themselves to compete successfully.

The majority of StanCharts revenue is derived in Asia, while up to half HSBC's business is based in the region – Australian banks individually generate far less proportionate revenue from the region and will face considerable difficulties providing a viable and meaningful transaction banking alternative to the market leaders. Citigroup’s success in building up just shy of a quarter of its revenue in the region illustrates the potential for greater development, however the length of time and ability for incumbents to price new entrants out of the market remain as significant hurdles to be overcome.

Existing banks in Asia such as DBS, Citigroup and Bank of China have nominated a wide range of impediments Australian banks will face in penetrating the highly competitive and in the case of many product lines, crowded market.

Differing regulatory frameworks raise concerns over maximum revenue potential. Malaysia enforces a 30 percent cap on foreign ownership of banks; however Australian institutions are keenly awaiting the outcome of reviews into relinquishing these controls in one off situations.

The size and scale of existing banks offers both opportunities and risks to new entrants. A niche offering to individual business segments may prove a profitable strategy; however the scope of the revenue benefits outweighing the significant costs associated with expanding into the region is yet to be seen. When ANZ’s CEO Mike Smith was asked if Australian banks can afford to diversify into Asia, his response was a calculated “Can you afford not to be in Asia?” Currently ANZ has not prised market share away from Citigroup, Standard Chartered or HSBC, however Mike Smith’s extensive experience in the region holds the bank in very good stead.

The increasing interconnectedness of Asian banking markets offers advantages to Australian banks well-planned strategic growth initiatives, although the RBA has warned against over extending too quickly without consolidating existing gains. CBA and ANZ have taken active hands on approaches, while NAB’s UK focus and Westpac’s domestic underpinning have resulted in a more measured approach to exploiting sky rocketing Asian wealth.

As with regulatory pressure limiting foreign control of local banks in Asia, local laws are adjusting to the ‘new normal’ international growth shift and asserting higher capital reserve requirements when acquiring foreign stakes.

The underlying reasons as to why Australian banks really are aggressively expanding into relatively turbulent and competitive Asian financial markets are compelling, and provide further justification for the high costs associated with breaking down the barriers to entry and establishment of market share, wallet share and mind share in the region.

Continued resources demand, although currently reduced in the short term, coupled with the geographic proximity of Australia work in the favour of Australian banks. Increased economic cooperation through organisations such as APEC and ASEAN offer defined conduits of trade finance and credit opportunities. The repatriation of European banks to their home countries has created a vacuum effect that already well positioned banks such as ANZ and CBA are clearly attracted to, focusing on vanilla product lines where they can offer a comparative advantage such as short term credit and trade finance.

Within the next forty years Asia is forecasted to boast over fifty percent of all global financial assets, with more companies moving their transactional business away from traditional hubs in New York and London, seeking better value for money and local expertise.

Australian based High Net Worth Individuals are increasingly seeking better value and service in terms of their transaction banking needs, with new tailored offering proving an attractive incentive.

Declining barriers to entry in China are also appealing to Australian banks, with Westpac and ANZ earning licences for direct convertibility of the Renminbi to Australian Dollars. Broadening financial services and business friendly reform offer unique opportunities to foreign banking entrants outside of the standard areas of operation that incumbent Asian banks are currently thriving in.

Needless to say the incentive to diversify abroad is not unique to Australian banks. This is illustrated by the higher outlay of foreign bank lending by Asian banks directly to Australia to the tune of nearly $40 billion according to the Australian Prudential Regulatory Authority –surpassing European bank lending for the very first time. It is little surprise given supressed European credit demand; low economic growth and high unemployment in Europe which fails to stack up against high levels of savings and generally positive sentiment in Asia.

Incumbent Asian banks face the challenge of defending their market share and avoiding customer churn in the face of increased Australian banking competition, while Australian banks must develop creative, sustainable strategies for building and maintaining new customer relationships. East & Partners Asian Institutional Transaction

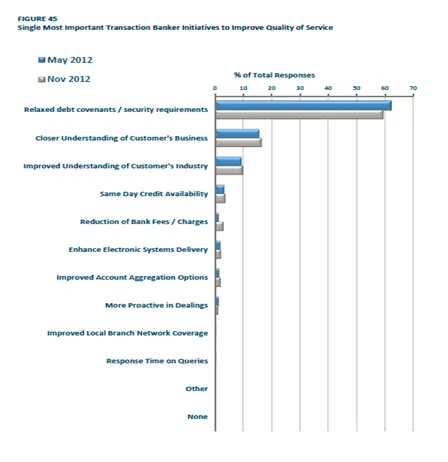

Banking research program finds that the single most important transaction banker initiative for improving quality of service, and by in large improving customer retention, is to relax debt covenants and security requirements. 59.3 percent of Asia’s top 1000 businesses by revenue nominate this as the number one service improvement area.

Positive externalities in the forms of lower churn, higher Market Share and stronger Wallet Share are all forecasted to arise from an increased focus on this important service area, whether you are an expansive Australian bank or incumbent Asian bank. See Graph 1.

Australian banks drive into emerging Asian markets is aspirational, given the dominant market share positions StanChart and HSBC hold over the transaction banking products the ‘Big Four’ Australian banks are predominantly targeting. Ultimately Australian Banks strategic focus is determined by the need to embrace change and leverage growing ties between Asian countries, or heed the advice of many analysts that believe the risks and inherent costs of expansion are too high. Banks such as ANZ would argue that this is delaying the inevitable, and pulls no punches in heralding the old mantra – Follow the Money. See Table 1.

Advertise

Advertise