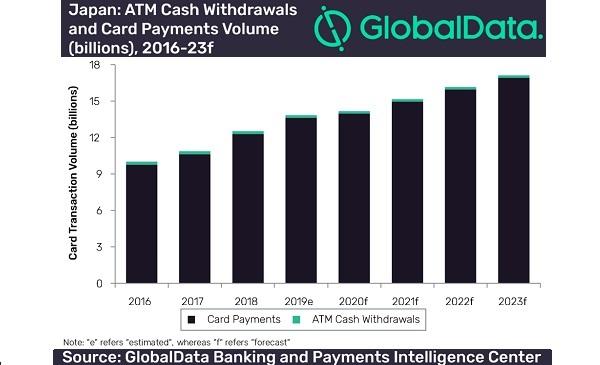

Chart of the Week: Japan's card payments to grow 2.6% in 2020

ATM cash withdrawals are expected to fall by 5.5% during the year.

The number of card payments in Japan will grow by 2.6% in 2020, according to forecasts by data and analytics firm GlobalData. At the same time, ATM cash withdrawals in the country are sighted to shrink by 5.5% over the year due to the coronavirus pandemic.

The pandemic is expected to push digital payments transaction value and volume among consumers and merchants as they shift away from cash payments to avoid exposure to disease vectors such as cash and POS terminals, noted GlobalData in a report.

“In order to avoid exposing themselves to disease vectors, increasing number of consumers are switching from in-store to online purchases. This will potentially benefit online payment solutions such as Konbini, Amazon Pay and PayPal,” said Ravi Sharma, lead banking and payments analyst at GlobalData.

GlobalData also observed a sharp rise in the cancellation of flights, hotel booking, and even the postponement of 2020 Olympic and Paralympic Games due to the Covid-19 pandemic. There is expected to be a decrease in consumer spending in 2020, particularly in sectors like travel and tourism, hospitability, accommodation, and food & drinks. These will in-turn impact cards and payment industry growth.

“As Japan imposed state of emergency involving social distancing and other restrictions until 6 May 2020, domestic spending will continue to remain weak with the deterioration in transaction volume during April-May. Payments sector is expected to revive towards end of Q2 2020 once the restrictions are completely lifted. Consumers are expected to defer on some of the high value purchases by few months at least till they have better view of the situation,” concluded Sharma.

Advertise

Advertise