Alternative payments reign supreme in Indian e-commerce market

Share in transactions hit 54% this year.

Alternative payments are getting traction in India as mobile and digital wallets gradually replace cash and cards as the pandemic continues, a GlobalData report said.

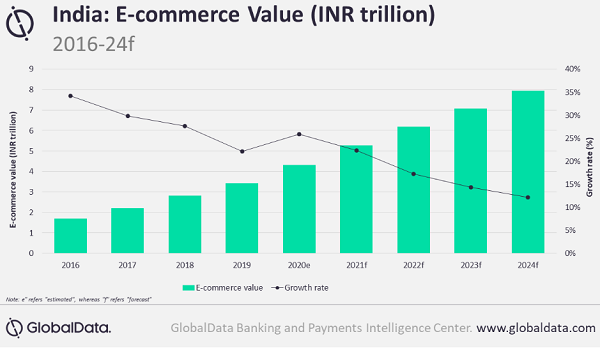

The country’s e-commerce market is estimated to be valued at $60.5b (INR4.3t) this year from $23.7b (INR1.7t) in 2016, representing a CAGR of 26.3% between 2016 and 2020.

The value is expected to increase further to reach $111.3b (INR7.9t)) by 2024.

The share of alternative payments in e-commerce transactions hit 54% in 2020, more than double from 25.3% in 2016. It is followed by payment cards and cash, which accounted for 30.1% and 8.1%, respectively.

Google Pay has largely benefitted from the growing digitalisation with 9.3% share in the total e-commerce payments, skyrocketing from 3.5% share in 2019. Paytm is still the leader with 10.8% share.

Advertise

Advertise