Mountain of evidence proves Asian banks fail to meet customers' mobile banking needs

Banks better catch up as there will be over 550m mobile banking subscribers by 2016.

According to a report by East & Partners exclusively released in Asia for Asian Banking and Finance, mobile money is taking off throughout Asia, but how prepared are banking providers to deliver what customers want, from large institutional clients to the person on the street?

Here's more from East & Partners:

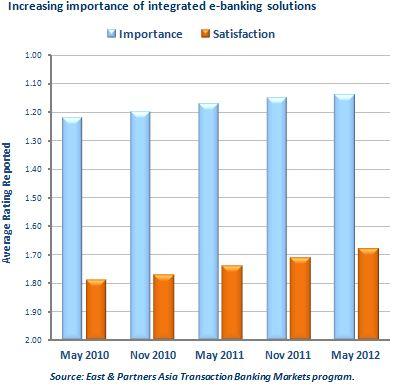

East & Partners’ Asian Institutional Transaction Banking Markets report reveals that integrated e-banking and internet banking are high priorities for institutional clients, and yet a significant gap persists between what the clients want, and what the banks are delivering.

East interviews 1,000 of Asia’s top corporates (ex-Japan) twice a year and the trend is clear. Customers want improved connectivity, mobility and better applications, but so far, their expectations are not being met, not yet anyway.

Beyond servicing institutional clients, there is also an opportunity for large multi-national organisations to partner with their banks in a mutually beneficial opportunity to improve customer acquisition and retention, while reducing operational costs at the same time.

By 2016, it is estimated there will be over 550 million mobile banking subscribers in a world which has more mobile phones than people. The Far East and China will have the highest penetration of users along with North America and Western Europe.

Banks are ramping up their technology spending on mobile solutions in all markets as customers’ demand “anytime, anywhere” banking, with an ever growing number of applications. But they may not have the market all to themselves.

In the retail sector, established banks face the prospect of competition from a new generation of providers, including telecoms and internet industry players, who are more nimble in their technology implementations.

In India, mobile banking currently only constitutes 0.1 percent of total banking transactions, but new mobile banking products and initiatives are being launched almost daily.

The first ever mobile signature solution in India was launched in November by software company Valimo and security provider Gemalto. In November, India’s second largest private lender HDFC Bank launched its mobile application in Hindi, the first service of its kind in the country.

In Bangladesh, the telecom regulator has halved the charges on mobile banking in a policy driven effort to popularise its take-up and bring the non-banking population into the banking market. The Philippines is looking at mobile phone banking as a new game changer in microfinance as it lowers transaction costs and improves convenience for customers.

Mobile banking, without doubt, is part of the momentum for financial inclusion in Asian nations with under-banked populations. In developed markets such as Singapore and South Korea, the mobile banking landscape – both for business and retail customers – is a technology battleground fought over not just by established banks, but payments and credit card companies as well as telcos.

Banks face a lot of challenges as this revolution gathers pace. Will they have a role to play in developing mobile commerce, as organisations increasingly use that as a channel to their customers?

Or will those customers themselves roll out mobile commerce solutions in alliance with technology partners, bypassing the banks?

Not so long ago, mobile banking meant a bank representative would come to your house or office. Now, it means using your smartphone. What we don’t yet know is the role that the bank itself will play in the mobile banking world of the future.

Advertise

Advertise