Trade Finance

Russia signs agreement with China Development Bank

Russia signs agreement with China Development Bank

Aims to attract financing for large infrastructure projects.

Meet Standard Chartered's new RMB solutions team

Standard Chartered has created an RMB Solutions team that is responsible for delivering bespoke client solutions to help them best capture...

Rabobank opens first Asian Structured Inventory Products desk in Singapore

SIP is a finance solution offered in trade commodity financing.

HKMA’s augmented RMB liquidity facility will benefit HK subsidiaries of mainland banks the most

Find out which banks these are.

Citi China unveils e-solution for RMB cross border settlement

First of its kind.

Standard Chartered RMB globalisation index up 4.8% in June

The rise was mainly driven by a rise in CNH FX turnover.

2 reasons why the Sino-US Dialogue did not focus on the value of RMB

The fifth China-US Strategic and Economic Dialogue concluded on 11 July. Unlike previous meetings, the emphasis was not on the value of the renminbi...

Looking at Asian companies' transaction banking relationships from a historical perspective

They want more than commoditised service.

First Hong Kong firm connects to Xetra trading system

Celestial Securities, Ltd is the first to connect.

Legal principles to watch out for in trade credit insurance

In my last article, I wrote about Trade Credit Insurance (TCI) and its usefulness.

Find out more about the ambitious 2015 Asia strategy of SWIFT's new deputy chief executive for Asia Pacific

Patrick de Courcy shares his 3 goals following his appointment.

Chinese RMB ranked 11th in world payments currency list

Thanks to all-time high market share of 0.87%.

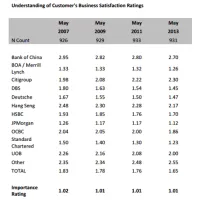

Which Asian transaction bank really understands their customers?

Understanding the Customer is a key metric in Asian Transactional Banking Markets, and is influenced by a growing number of product and service...

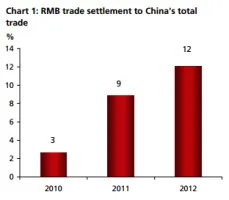

What you need to know about simplified RMB cross-border trading

On 10 July, the People’s Bank of China (PBoC) announced a series of measures aimed at simplifying renminbi (RMB) cross-border transactions.

Standard Chartered China completes RMB2.7b cross-border lending deal

It's the first deal post-PBOC's circular.

HSBC appoints Luiz Simione as global head of forfaiting & risk distribution for global trade and receivables finance

Luiz Simione has been appointed Global Head of Forfaiting & Risk Distribution for Global Trade and Receivables Finance (GTRF), HSBC, with effect from...

3 key measures to simplify RMB cross-border transactions

Find out what the market implications are.

Advertise

Advertise