Singapore

Weekly Global News Wrap Up: UK banks hit by Brexit-induced investment slowdown; Deutsche Bank to pay $197m to settle bribery case

And BNP Paribas will pull out from financing private prison firms.

Weekly Global News Wrap Up: UK banks hit by Brexit-induced investment slowdown; Deutsche Bank to pay $197m to settle bribery case

And BNP Paribas will pull out from financing private prison firms.

Virtual banks may only account for less than 1% of Singapore loan market by 2022

Retail upstarts may account for 0.3% market share and wholesale challengers will take 0.9% of the market.

Citi launches payment outlier detection service

It uses advanced analytics, AI and machine learning to detect irregularities.

Weekly Global News Wrap Up: Societe Generale reportedly eyeing to sell UK private banking arm; Wells Fargo slapped with $6.61m fine in Ireland

And bank licensing boom hits South Africa.

How GoBear makes financial comparison easy for the everyday consumer

Its platform matches users with financial products like insurance, credit cards, and trade finance.

Singapore's fintech invasion has no end in sight

About 43% of fintechs in Southeast Asia choose Singapore as their home amidst strengthening growth prospects.

Weekly Global News Wrap Up: Deutsche Bank reportedly eyeing to cut 20,000 jobs: EU banks short of $153b to meet capital requirements by 2027

and Austrian banks survive government's staged cyberattacks.

JP Morgan launches working capital index

Companies can identify inefficient use of liquidity and improve internal funding sources.

Singapore's fintech adoption rate almost tripled to 67% in two years: study

It is ahead of the APAC average adoption rate of 64%.

Singapore banks' loan growth up 4.7% in May

ACU-driven overseas loans rose 7.5%.

Singapore joins digital banking race with five licenses up for grabs

The five licenses are split into two full digital and three wholesale.

Citi appoints Hsiu-Yi Lin as ASEAN commercial bank head

Citi named Hsiu-Yi Lin as ASEAN Head of Citi Commercial Bank (CCB). She will lead the CCB business across ASEAN in addition to her current role as CCB Head for Citi in Singapore. With her new role, Hsiu-Yi will be responsible for driving business strategy across ASEAN where Citi banks on multinational and local clients across Singapore, Malaysia, Thailand, Vietnam and Indonesia. Hsiu-Yi has over 25 years of experience in the banking industry including securitization, treasury, trade and product management in the US and Asia. She has been the head of the CCB Singapore since 2013. Born and raised in Malaysia, Hsiu-Yi holds an MBA from Harvard Business School and a Bachelor of Arts degree in Computer Science and Physics from Wellesley College. “Hsiu-Yi’s strong track record in managing various businesses across different markets means she is well placed to further grow our business in ASEAN,” said Rajat Madhok, Citi head of commercial banking, Asia Pacific.

UOB temporarily loses $2b of market value

Despite suspicions of trading error, the SGX upheld the trade.

UOB ties up with fashion e-commerce platform Zilingo

Zilingo merchants and manufacturers can directly access UOB's banking solutions.

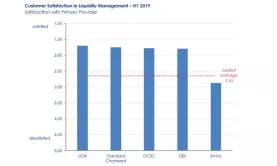

Which Singapore bank enjoys the highest corporate customer satisfaction?

A homegrown bank pulled ahead of global rivals like Standard Chartered.

Weekly Global News Wrap Up: Credit Suisse to sell B2B investment fund platform; Citi kills some card perks

And German banks could face $695m over dividend tax concerns.

UOB and CapBridge to offer Asian firms access to private capital

CapBridge’s investment syndication platform will match UOB clients to anchor and accredited co-investors.

Advertise

Advertise