Malaysia

RHB Singapore's O&G exposure still 'manageable'

O&G loans currently account for 3.6% of total loans.

RHB Singapore's O&G exposure still 'manageable'

O&G loans currently account for 3.6% of total loans.

RHB Bank launches regional peer-to-peer financing platform

The bank partnered with Funding Societies Malaysia.

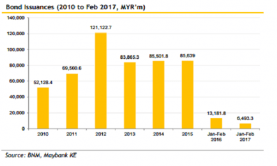

Chart of the Week: Malaysian banks' bond issuances still lagging

Issuances only totalled US$1.1b in February.

Sharia-compliant investment accounts at Malaysian banks hit US$16.7b in February

Growth will remain strong over the next 3-5 years. An emerging trend among Malaysian banks is the strong growth of Sharia-compliant investment accounts, report Moody's. This began in July 2015 following the implementation of the Islamic Financial Services Act 2013, and has since taken off. Sharia-compliant investment accounts (“investment accounts”) are defined in the Act as accounts under which money is paid and accepted for investment in accordance with Sharia principles and on terms that state there is no express or implied obligation to repay the money in full. By February 2017, investment accounts had grown to MYR74.2 billion (US$16.7b), or 13% of total Islamic banking system liabilities. Here's more from Moody's:We expect growth in investment accounts in Malaysia to remain strong over the next 3-5 years as a result of the active promotion by the regulator and banks. Malaysian banks have strong incentives to promote investment account growth because it provides capital benefits and an additional source of funding to grow their assets. Concerns over untested loss-sharing mechanisms in investment accounts. Banks could suffer deterioration in their credit profiles if the loss-sharing mechanism in these investment account products turn out to be less robust than currently assumed. At the present development stage of Malaysia’s investment accounts, a key issue is whether, and to what extent, the loss-sharing mechanism between banks and investors will be honored in case of actual losses. Similar products in other regions have led banks to bear the entirety of the asset risks. Our concern is underpinned by our observation that Islamic banks in other Islamic jurisdictions, notably some Gulf Cooperation Council (GCC) countries, in practice do not exercise the contractual loss-absorbing nature of investment accounts, and as a result, bear much, or all, of asset risk on behalf of investment account holders. This is perhaps because of customer expectations and out of fear of reputational damage. Safeguards are present to protect banks. A mitigating feature for Malaysia is that regulators have put in safeguards to protect banks. In Malaysia, the regulatory framework

(1) identifies and differentiates the risk profile of investment accounts from traditional principal-guaranteed deposits; (2) emphasizes the disclosure of the risk-sharing mechanism in investment account products to investors; and (3) obliges the investment account holders to share risks with the banks.

Malaysian banks' absolute gross impaired loans up 4.6% in February

Overall GIL ratio is stable at just 1.63%.

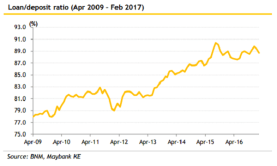

Chart of the Week: Malaysian banks' loan-to-deposit ratio dipped to 88.7% in February

The loan-to-fund ratio was lower at 83.4%.

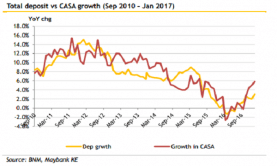

Malaysian banks' total system deposits grew US$1.6b in February

CASA continued to expand at a faster rate of 5.8%.

Malaysian banks' loan growth slipped slightly to 5.3% in February

Loan growth slowed across most key sectors.

CIMB launches Alipay mobile wallet in Malaysia

The service will go live by May 2017.

Malaysian banks' loan growth expected to moderate to 4.7% in 2017

Household debt/GDP is down for the first time in 7 years.

Malaysian banks' external liabilities hit US$39.6b in 2016

It accounted for 17.3% of the banks' balance sheets.

Chart of the Week: Malaysian banks' total deposits vs CASA growth

Deposits increased US$1.5b in January 2017.

RHB appoints Michael Chang Wai Sing and Mohd Fauzi Mohd Tahir as chief investment officers

RHB Asset Management Sdn Bhd, a wholly-owned subsidiary of RHB Investment Bank Berhad, is pleased to announce the appointments of Michael Chang Wai Sing and Mohd Fauzi Mohd Tahir, as Chief Investment Officer – Fixed Income and Chief Investment Officer - Equity (Malaysia) respectively.

CIMB eyes 7% loan growth in FY17

The bank has fared well in sustaining loan growth momentum.

Malaysian banks' deposits up 4.2% in December

Guess which bank had the heftiest increase of 16%.

Loan-to-deposit ratios up for all Malaysian banks but one in 4Q16

Average LDR for banks jumped to 93.5%.

Bank loan applications in Malaysia drop for the seventh consecutive month

Loan approvals also contracted 5.1% in January 2017.

Advertise

Advertise