Lending & Credit

Mizuho invests $145m into Credit Saison India

CS India has 1.2 million active loans and assets under management of $1.2b.

Mizuho invests $145m into Credit Saison India

CS India has 1.2 million active loans and assets under management of $1.2b.

Bank Mandiri’s loan quality improved moderately in 2023: Moody’s

Share of impaired loans were “modestly lower” compared to 2022.

China’s new bank loans hit record high in January: report

Officials are also rolling out more measures to support the economy.

India’s private banks’ NIMs contract 32 basis points in Oct-Dec 2023

Growth in unsecured loans is expected to slow, which will impact credit growth and NIMs.

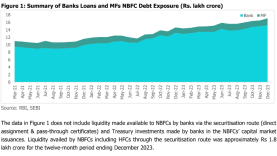

Chart of the Week: Indian banks’ credit exposure to NBFCs slows in Dec

However, the growth trajectory is still higher compared to a couple of years ago, data showed.

Thai banks brace for a rise in loan defaults in 2024: analyst

The sector grapples with elevated costs and weak loans, S&P said.

Korean financial regulator vows to fight contagion risks from property financing: report

Lee called these real estate PF risks a “detonator” of the South Korean economy.

APAC banks face mounting credit losses from property exposure

Credit losses could rise 7% to $490b in 2023, S&P Global Ratings projected.

Thai banks’ credit costs rise as tech difficulties, bad loans pile up

Despite their targets to decrease costs, three banks saw them rise instead.

Commercial property woes weigh on Hong Kong banks

But receding risks in mainland China properties will help offset impact, says Fitch.

Citi Korea to enjoy strong capitalisation, stable credit profile through 2025: Moody’s

The bank’s winding down of its consumer banking business is a positive.

SMBC subsidiary establishes aircraft financing, leasing platform

The investment is targeted at US$1.5b for a three-year period.

Thailand banks’ profits underperform in Q4

Thai banks are expected to see THB130b in new bad loans in Q1, UOBKH warns.

Higher loan demand, low credit losses spell better year for PH banks

Philippines’ digital banks will continue to make losses due to weak asset quality.

Thailand’s KBank targets 5% loan growth in 2024 under ‘3+1’ strategy

The bank is scaling up its wealth advisory business to grow fee income.

Majority of Philippine banks to maintain lending standards in Q1: survey

Banks maintained their credit standards for households, corporates in Q4.

Thailand’s KBank unlikely to meet credit cost normalisation target: analysts

Credit costs are expected to remain at a high level in 2024.

Advertise

Advertise