Economy

Overseas Filipinos’ remittances up 3% to $2.95b in Feb

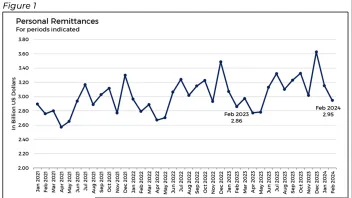

Overseas Filipinos’ remittances up 3% to $2.95b in Feb

A total of $2.65b in remittances coursed through banks, the central bank said.

Personal remittances from Overseas Filipinos (OFs) grew by 3% to $2...

Singapore banks’ interest rates will remain elevated until Q3: analyst

DBS and OCBC are expected to provide dividend yield of 7.4% and 6.5%.

Asian banks struggle with less liquidity amidst global slowdown

Shifting economies and interest rates shape the banking landscape.

'Tighter' financial conditions to weigh on Singapore's lending market: MAS

Risks include high inflation, geopolitical tensions, and spillovers from China's economic situation and global real estate market strains.

Model risk management vital for banking innovation

Ensuring effective decision-making and addressing new challenges like climate risk through robust model risk management.

Nature's decline threatens $10 trillion global GDP by 2050

There is a critical impact of biodiversity loss on the economy and the opportunities in sustainable investing.

Fed policies shape APAC bond markets

The impact of Federal Reserve's decisions on Asia-Pacific local currency bonds reflects in interest rates.

Bank of America eyes client-focused approach amidst Malaysia's economic rebound

Bank of America was named as the top investment bank in Malaysia in 2023 based on M&A deals and services offered.

BSP: cap on online payment facilities to stay

This aligns with the BSP's ongoing efforts to encourage digital financial transactions.

MAS: freeze remittances to China for the next three months

It is effective from 1 January 2024 to 31 March.

APRA updates banking standards to manage interest rate risk more effectively

The updates aim to reduce volatility in the IRRBB capital charge, enhance incentives for risk management, and simplify the IRRBB framework.

APRA keeps current macroprudential policy settings

Cost-of-living, the economic outlook, labour market, and borrowing cost were factors considered.

MAS and Bank Indonesia extend bilateral financial arrangement until 2024

The agreement between both central banks was extended to 2 November 2024.

DBS unveils financing solution to boost SMEs’ sustainability ventures

The DBS Eco Renovate Loan allows SMEs to finance up to 100% of their expenses related to sustainability.

Central bank announces new savings bond with average yield of 3.32%

Its amount offered is at $1b.

Public bank ties up with gov’t to finance SMEs

Domestic exposure for SME-based commercial lending is equivalent to an 18.6% industry market share.

BDO Capital's president shares insights on infrastructure financing in the Philippines

In a recent ASEAN meeting, ministers emphasised the need for post-COVID financial solutions in Southeast Asia, shining a spotlight on the critical...

Advertise

Advertise